The financial industry in a forever changed world

Fintech, banks, and insurers are facing unprecedented disruptive challenges. People power can help solve them.

The financial industry in a forever changed world

Fintech, banks, and insurers are facing unprecedented disruptive challenges. People power can help solve them.

It would be an understatement to say that the past years have been disruptive. Covid, the US election, fake news and conspiracies, Brexit, climate change, recession fears, ongoing global conflicts, the list goes on and on. But one thing truly stood out. The Covid-19 pandemic. It has impacted our world in every way. Socially, politically, and economically. For good and bad, everyone has been affected by this global health crisis.

- Foreword

- Introduction

- The impact of COVID-19

- COVID-19 and the banking sector

- COVID-19 and fintech

- COVID-19 and the insurance industry

- Post-Covid – what next?

- Welcome to the digital revolution

- Open banking and security – the necessity of payments testing

- Social distancing and lockdowns – boosting the cashless society

- The power of people

- The right test for the right transaction

- Testing to build trust

- Sources

As an organization that works with a community of 600,000 people worldwide, we are particularly concerned about Covid’s impact on human life.

But we are also optimistic. We are not only witnessing a surge in digitalization and tech innovation but a clear change in consumer and business behavior. For all industries, these changes can help ensure we all come out of this crisis stronger than before.

This is our ‘new normal’. Being agile isn’t just a competitive advantage, it’s how businesses must be run. For the financial industry, this is essential.

Banks, which play a vital role in ensuring people receive stimulus and relief assistance, and in stabilizing the economy, must be steady and secure during such times – while being able to adapt to changing regulations and other disruptive challenges, such as the growth of fintech.

Insurers need the flexibility to quickly react to new policies and government expectations on assessing claims, to offer more consumer/business-friendly solutions, and to focus on digitalization as personal interactions remain blocked and may never reach pre-Covid levels again.

Our world has changed. Rapid digital transformation, online-only transactions, open banking regulations, and ever-evolving consumer expectations are all providing unique challenges and opportunities.

“It’s many of these that we want to discuss while showing how the power of people can help. Once you finish reading, if you have any questions or are looking for help in your digital journey, please feel free to get in touch and we can discuss how Testbirds can help.”

Georg Hansbauer, CEO & Co-Founder, Testbirds

Introduction

On March 11, 2020, it became official. The World Health Organization declared COVID-19 a pandemic. Business stopped, schools closed, travel halted, and communities – whole countries – went into lockdown. Beyond the clear need to protect public health this meant many businesses were quickly struggling for their very survival. Globally, many thousands have since closed their doors for good while unemployment rates, especially among low-income workers, have stayed high.

As with most global events, the ongoing Covid pandemic has created a significant economic challenge for all industries. Insurers, banks, and the rapidly growing fintech industry are no exception.

Covid, however, is only one challenge. As businesses slowly move from survival mode, they must adapt to new customer behaviors, alternative methods of doing business, changing governmental regulations, and disruptive competitors.

In the post-Covid years ahead, developing digital technologies will be essential for any business that wants to thrive. As social distancing continues, remote work increases, and online everything gains ever-more traction, digital solutions are must haves. This will make payments testing an area that requires close attention.

Digitalization is also encouraging new forms of competition with open banking being embraced by countries around the world.

“COVID-19 is reshaping the global banking industry on a number of dimensions, ushering in a new competitive landscape, stifling growth in some traditional product areas, prompting a new wave of innovation, recasting the role of branches, and of course, accelerating digitization in almost every sphere of banking and capital markets.”

DELOITTE1

Both are also helping to drive a boom within the fintech industry.

But such a surge in digital solutions means there cannot be any compromise on security, reliability, and speed. It also means building solutions that consumers and business users can fully trust. This whitepaper takes a deeper look into the challenges facing the financial industry, including the ongoing Covid pandemic and the issues and opportunities that digitalization, payments testing, and open banking pose.

The impact of COVID-19

The Covid pandemic is a once-in-a-generation global event that has created instability, volatility, and uncertainty throughout every industry in the world.

In 2020 its impact on the global economy was significant. Not only did annual GDP growth rates decline in every country2 but global wealth per adult fell by 4.7 percent and total global household wealth dropped by 4.4 percent.3

According to the International Labour Organization report, “ILO Monitor: COVID-19 and the world of work,” global labor income dropped by 10.7 percent (equivalent to $3.5 trillion compared to the first three quarters of 2019). Additionally, global labor income was estimated to have declined by 8.3 percent, or about 4.4 percent of global gross domestic product, while employment losses reached an unprecedented 114 million jobs relative to 2019.4

In the US alone, roughly 200,000 businesses closed in 2020 above historical levels.5 The International Monetary Fund’scWorld Economic Outlook, April 20216 showed just how drastic the pandemic was in 2020 compared to 2021:

Globally, real GDP growth in 2020 was -3.3 compared to the projected growth of 6.0 in 2021 and 4.4 in 2022. This trend was seen in every region.

But as the projections show, the negative impact is likely to be short-lived. Though this will certainly be affected by ongoing spikes in infection rates with the new virus variants, additional lockdowns, and vaccine coverage.

Overall, however, throughout 2021 there have been signs of recovery as vaccination programs rolled out around the world, lockdowns were relaxed, and businesses reopened. The latest estimates by the International Monetary Fund suggest that global GDP in 2021 will total $93.9 trillion (up 11%) and $1.5 trillion below the pre-pandemic forecast. Credit Suisse, in their Global wealth report 2021, expects that global wealth will ‘rise by 39% over the next five years’.7 While up to July 2021, US personal consumption expenditures also increased month-by-month to finish at 0.3%.8

“We’re recovering, but to a different economy.”

However, even as late as August 2021, global trade was negatively affected as Covid-19 outbreaks resulted in the closure of manufacturing centers and ports in China and Japan.9 All signs that a full recovery will not happen overnight. These ongoing ‘ups and downs’ are impacting industries in diverse ways. In their joint whitepaper, ‘Emerging Disruptors from the Global Pandemic’10, Cisco and Jungle Ventures looked at who was most disrupted by the pandemic regarding their business continuity and demand. Travel & Hospitality topped the list, followed by Healthcare, Supply Chain & Logistics, Education, Retail, and Financial Services. Of all industries, Financial Services were disrupted most equally between continuity and demand. This creates unique challenges.

COVID-19 and the banking sector

As the pandemic took hold, banks were in a much stronger position than they were during the 2008 financial crisis. Specific laws that were enacted at the time, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, helped introduce various regulations – from stress testing to load reserve policies – which likely kept the health crisis from also becoming a financial one. Within the EU the establishment of the European Banking Authority and the rise of various independent authorities, such as the European Securities and Markets Authority, also assisted this.

Federal stimulus packages, the paycheck protection program, and a slow-down in consumer spending also meant that banks had high liquidity. However, at the same time, businesses were borrowing less, loan delinquency rates rose, consumer loan balances dropped, and nonperforming loans increased. Additionally, many branches closed as lockdowns limited human interaction. This meant more spending had to be made in the development or upgrade of digital, contactless solutions.

With global capital markets remaining in a state of flux, valuations and business confidence continue to be adversely impacted. With no clear idea of what may happen tomorrow, businesses and consumers were, and continue to be, understandably cautious with borrowing and moving money.

Businesses may also adopt a …

Morepermanent work-at-home model, which could impact commercial real estate loans. Store closures or reductions will also influence whether retailers need bank loans to finance their business spaces. Even changing business models and new supply chains could significantly reduce their need to borrow.

As government aid to businesses and individuals stops before employment levels rise to pre-Covid levels, there is an increased possibility of defaults and delinquencies. There is also the potential for economic growth to stall.

A recent PwC COVID-19 US CFO Pulse Survey11 showed that 70% of respondents saw a potential global recession as one of their top three concerns in respect to COVID-19. Seventy-five percent were concerned with the ‘Financial impact, including effects on results of operations, future periods and liquidity and capital resources.’

A slowing economy would impact job growth, wages, and spending. This will significantly impact the demand for loans and deposits.

All of this has seen banks focus on several specific areas:

- Risk management, especially regarding interest rates and credit, potential regulatory changes, and their ongoing operations. Mitigating risk will be an ongoing concern. Some EU banks are already posting significant losses ‘to face a potential surge in bad loans’.12

- Loan impairment as principal and interest payments come under an increased threat of not being collected.

- Customer service. Changing expectations and preferences, combined with branch closures, is accelerating the trend toward using financial apps, contactless solutions, and online banking.

- Digital transformation. Not only to ensure operations can be quickly, and agilely, scaled but that capabilities can be seamlessly adapted to new situations.

COVID-19 and fintech

As the pandemic progressed throughout 2020 and into 2021, fintech was able to quickly bridge the gap between changing customer needs and expectations – especially in how people managed their money – and traditional financial services.

While the trend toward providing personalized, affordable, and immediate, 24/7 access to consumers has been steadily growing in the past years, isolated lockdowns and social distancing have seen the adoption of online communication tools and financial technology apps skyrocket.

This accelerated demand for digital offerings has, according to the ‘Global COVID-19 FinTech Market Rapid Assessment Study’13 by the Cambridge Centre for Alternative Finance, The World Bank, and The World Economic Forum, seen the global fintech industry grow during the pandemic. Some 60 percent of surveyed firms launched new products or services or revamped their existing ones. Growth, however, has been uneven across regions, markets, and business models. 12 out of 13 sectors reported year-on-year growth in the first half of 2020, compared to the same time in 2019.

Digital payments, digital savings, wealth tech, and digital asset exchanges proved to be amongst the best performing sectors. This was followed by digital banking and digital identity. Digital lending was the only sector that reported a decline.

Unsurprisingly, the expansion of transactions was higher in countries with strict lockdown measures, where growth was up to 50 percent higher than those operating in countries with less strict lockdowns. Those operating in emerging markets and developing economies also reported higher growth than those in more advanced economies but that they had ‘larger increases in operational challenges, costs and risks’.

As the pandemic continues, there is little doubt that fintech will be increasingly essential in providing alternatives to traditional financial services and ensuring financial inclusion to those unable to physically visit banks, credit unions, and retailers.

COVID-19 and the insurance industry

For insurers, 2020 should have been a solid year. In 2019, gross premiums and life insurance grew 4.4 percent, property and casualty fell to 4.3 percent. The US and Western Europe markets grew 4.2 and 4.3 percent.14 But by April of 2020, the entire market was quickly put under significant pressure, and there were already calls that the Covid-19 response could bankrupt the industry.15 As of September 2021, hundreds of thousands of businesses have closed for good, ongoing lockdowns are causing additional hardships through redundancies and reduced trading, mass events have been canceled, and official figures show that close to 220 million people have tested positive for Covid and over 4.5 million have died from the virus.16 New models, however, are estimating the true death toll could be as high as 15 million.17

This is a clear and ongoing issue for all fields within the insurance industry that may be directly exposed to Corona-virus-related losses. For example, property and casualty insurance must deal with business interruption claims and the inevitable legal challenges, and even state intervention, for ‘virus exemptions’.

General liability will see third-party claims …

Morefor injury or property damage relating to claims that a business’ negligence led to a failure to protect from the virus. This is particularly relevant for event organizers, retailers, and employers. For insurers operating in long-tail businesses, the true impact could take years to be fully clear. But with so many business closures, deaths, and ongoing health issues such as ‘long-Covid’, event cancellations, and more, the impacts are being felt throughout various coverage areas.

More so because throughout the pandemic insurers have been expected to work as normal, even as remote customer queries experienced an unparalleled increase, workforce disruptions and remote working placed huge stress on operations, asset values were disrupted, and as IFRS 9, IFRS 17, and US GAAP LDTI programs continued.

While business continuity plans were activated en masse, which has helped mitigate many issues, business-critical systems and applications needed to be available to employees who were now working remotely. This also so customer engagement was not adversely affected. All this would have been extremely difficult without digital solutions, such as artificial intelligence, and an effective and secure online presence.

The past years have seen the industry gradually embrace digitalization as a way of meeting the rapidly changing expectations of today’s consumers. Fast, personalized, always-on services that can be accessed from any device and any location.

The pandemic has ensured that this adoption has rapidly increased.

Show lessPost-Covid – what next?

As of March 2022, the pandemic will be two years old. Many industries, including the banking and insurance sectors, have turned to technology and remote solutions to survive. Remote work is now widely seen as a viable working solution. For many businesses, this will become standard.

Technological solutions that enable consumers to remotely use services or go shopping are now mainstream. The pandemic won’t be here forever, but it is fundamentally changing how every industry conducts business.

Digitalization will quickly phase out more traditional ways of doing the same thing – particularly regarding customer interactions, how risk is assessed, how disruptions are mitigated, and how next-generation business models are developed. A significant challenge will be ensuring that each technological solution is fully optimized to meet these unique challenges.

Structured Bug Testing

Make sure the core functions of your digital product are bug-free. Let the Crowd test it step-by-step according to detailed use cases.

Find out moreWelcome to the digital revolution

Research from the Pew Research Center and Elon University asked 915 innovators, business leaders, researchers, and activists what they felt life would be like in 2025 in a world changed by the Covid pandemic. “Their broad and nearly universal view is that people’s relationship with technology will deepen as larger segments of the population come to rely more on digital connections for work, education, health care, daily commercial transactions and essential social interactions. A number of them describe this as a “tele-everything” world.”18

The pandemic has also, according to a McKinsey Global Survey of executives, “accelerated the digitization of (companies’) customer and supply-chain interactions and of their internal operations by three to four years. And the share of digital or digitally enabled products in their portfolios has accelerated by a shocking seven years.”19

This is our ‘new normal’. For the banking and fintech industries, this is coinciding with the rise of open banking. A technology-driven solution (secured in the EU according to the revised Payment Services Directive ((PSD2)) regulation20) that enables the sharing of data not only between a bank and its customers but between any number of third-party services, other banks, retailers, and much more. Within the EU, PSD2 Access to Account has been mandatory since January 2018. The PSD2, according to the European Central Bank, “supports innovation and …

Morecompetition in retail payments and enhances the security of payment transactions and the protection of consumer data”.21 All institutions that provide payment accounts must give access to regulated third-party providers if the customer gives ‘explicit consent’ for their data to be shared.

Within North America, banks may soon officially follow suit. On July 9, 2021, President Biden’s ‘Executive Order on Promoting Competition in the American Economy’22 laid out the regulatory structure to solidify efforts to create open banking solutions. Specifically, that: “The Director of the Consumer Financial Protection Bureau (CFPB), consistent with the pro-competition objectives stated in section 2021 of the Dodd-Frank Act, is encouraged to consider:

- Commencing or continuing a rulemaking under section 1033 of the Dodd-Frank Act to facilitate the portability of consumer financial transaction data so consumers can more easily switch financial institutions and use new, innovative financial products.”

For customers, open banking can offer a fast, easy, and more user-friendly experience that provides more options, choices, and tailored offerings. Securely. Ultimately, it can give them more control over their financial information across any number of devices. The benefit of this during periods of lockdown is clear.

Banks that adopt an open banking model can provide additional services, expand offerings, and even monetize their customers’ data. A 2017 Accenture report noted that such banks could increase revenue by 20 percent, while those who did not, could lose 30 percent.23

With access to consumer financial data, financial service startups will be in a stronger initial position to innovate and create new revenue models. App developers, who use an application programming interface (API) can collect and utilize data to create new services without customers having to access their underlying accounts.

Show lessOpen banking and security – the necessity of payments testing

Data security, enforced within the EU regulation, comes from the use of open (or public) APIs, alongside the use of Strong Customer Authentication, and is re-enforced with only licensed and regulated third-party providers authorized to build such financial apps and services. The challenge in doing so is made even more complex when enabling secure, easy, and transparent access to different banks and markets through a single interface. Especially as all have different systems, processes, and standards. If one institution’s nomenclature is radically different from another, the unified system must cope.

In addition to viewing data, one of the biggest benefits to open banking is the ease of making a transaction and of receiving one. Today, many retailers allow small transactions by letting shoppers swipe their card across a terminal – with no need to input a PIN. However, an extensive range of different payment types are becoming available, they can be high or low transactions, recurring, domestic, international, or card on file. This means that priority must be given to providing adequate test coverage. Particularly when using an open API that may be used across multiple devices.

Because of this, plus the huge surge in digital products during the pandemic and the drive to a more cashless society, payments testing, already a critical component of transaction development, is set to become even more essential.

For customers, payments testing helps ensure easy, seamless, and secure transactions. No matter what type of payment method. It also enables gateways and facilitators to deliver secure, validated, and reliable payment flows. Acquirers and processors can assure their clients that payments are running smoothly and safely. Payment networks can test that the millions of transactions they deal with every second go through correctly and swiftly.

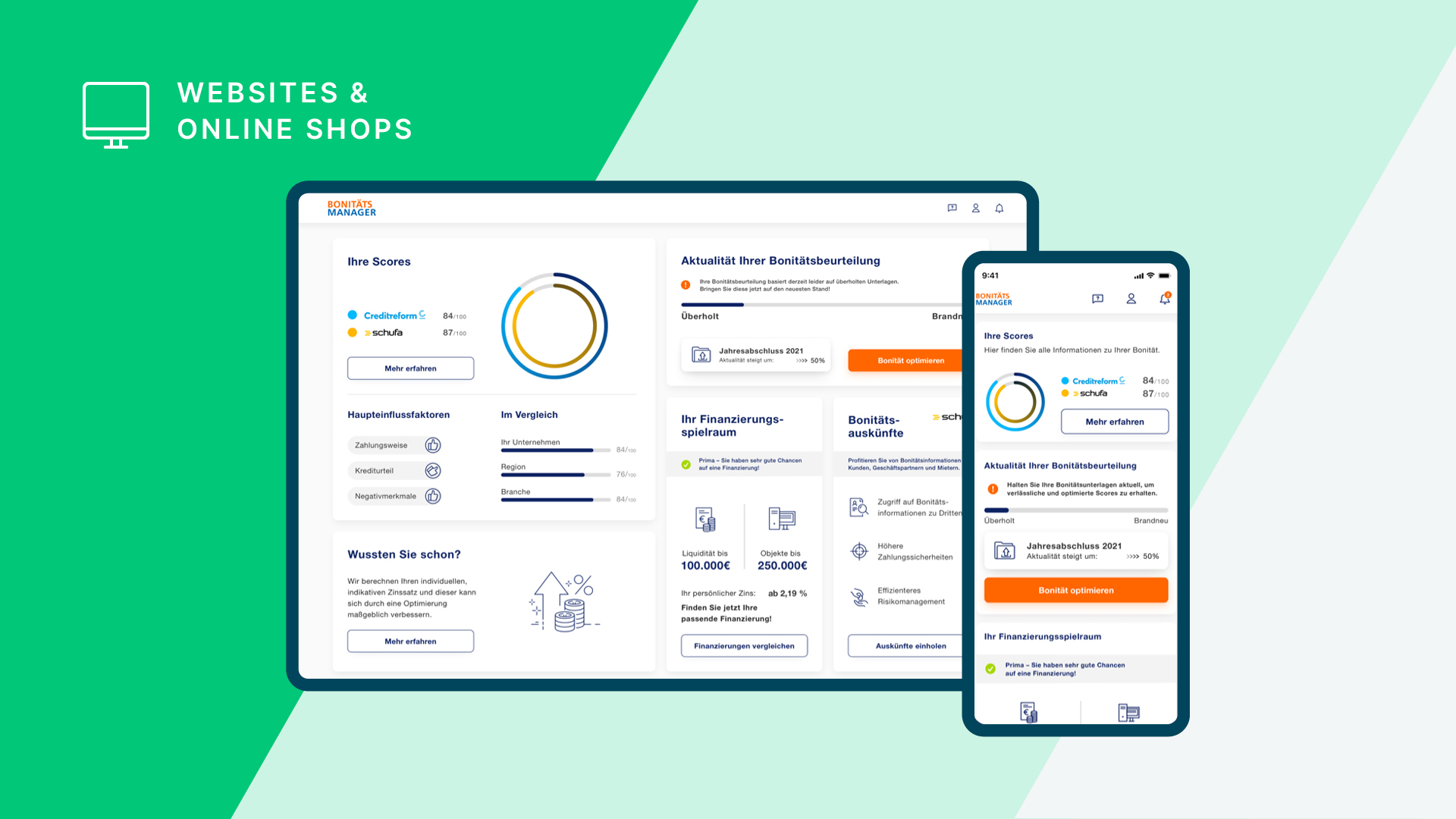

VR Smart Finanz - Holistic commercial user experience testing

The power of people

At Testbirds, we aim to build a better digital world – together. Through our crowdtesting services, we can provide 600,000 testers from around the world using over 1 million different devices to test products as real users in real-world conditions. This is extremely important when it comes to ensuring that financial solutions are secure, user-friendly, and operate correctly on any number of devices, at any time, from any location. Proper testing can help ensure an excellent customer experience that builds trust.

For open banking, this is a necessity.

Every time a user accesses their payment account online, initiates an electronic payment transaction, or carries out any remote action, they need to trust that it will be secure and not open to any payment fraud or other abuses. Confirmations must be validated. Performance must be correct and fast. Payment processes need to work across multiple devices and that all authentications are correctly triggered.

Appropriate quality assurance, user experience, and usability testing can mitigate such issues. Our crowdtesters can perform multiple transactions to validate your Account Information Service, Payment Initiation Service, and Strong Customer Authentication, across an extensive range of payment types.

The right test for the right transaction

To ensure that payments testing is accurate and secure across devices, a wide range of tests may need to be performed. By utilizing real people, rather than virtualization or automated testing, each approach makes the best use of actual human reactions and feedback. Products and services are used, by testers that match customer profiles, exactly as those customers would. Essentially, they are the customer. This is especially useful in neutralizing the effects of operational blindness by giving an unbiased view of the product, regardless of the test.

Functional testing lets developers determine if a solution works exactly as intended, is useable and accessible, and that it works by itself and with other components by testing each of its functions.

Usability testing evaluates whether a product or service is difficult to use, is user-friendly, or does not meet the needs and wants of its users. For example, seeing if it is obvious where banking details should be entered or that it is clear how to scan a card.

Integration & compatibility testing can help verify that the payments solution works with all necessary devices, websites, or applications. Also, that orders can be placed, funds received, and that each transaction can be verified, refunded, or made void.

Performance testing helps ensure that the payments system works under a range of workloads. That it is stable and responsive whether two or two thousand people use it at the same time.

Security testing makes sure that sensitive information is encrypted, that channels are safe, and that the solution is protected when used, alongside, or within other products.

Localization testing checks that the payments solution not only meets the needs of regional target audiences but that it adheres to local standards, regional customs, and cultural sensitivities. That formats, icons, colors, and more are consistent with the local area. That the solution can work once all regional inputs are in place.

By placing the human element into each type of test, in addition to removing operational blindness, solutions can be quickly adapted to meet real needs and changing expectations. In 2019, a retailer may have seen an online or contactless payments solution as a ‘nice to have’ but within months it became a necessity.

As the world gradually enters a post-Covid reality, the amount of payment options will only increase because the way people want to pay is rapidly changing. Convenience and ease of use are paramount. Moving forward, payments testing needs to be as flexible and ‘experience-focused’ as the solutions being developed. Crowdtesting with real people ensures it can.

Testing to build trust

The past year and a half have highlighted the importance of trust – in many ways. People have been placed in isolated situations that have severely limited human interaction and access to their banks and insurers. This has placed a huge responsibility on financial solutions to work correctly and flexibly.

It may take years to build trust, but one data breach or one failed transaction can see customers permanently walk away. As open banking becomes more widespread and payments solutions become more varied, adequate testing ensures that bugs are found and fixed before the solution is released, that it works with legacy systems, meets various regulations, and can work in any situation that a customer faces. That the solution can be trusted.

Our world has forever changed. The way people interact with many businesses will never be the same again. How everyone reacts to each other may take years to be what it was. If ever. Financial solutions must take this into account.

What users expect and want now is different to early 2020. Solutions must address this ‘new normal’ for businesses to truly thrive – rather than survive.

“We don’t heal in isolation, but in community.”

S. KELLEY HARRELL

Through the power of people, crowdtesting can help organizations see, in real time, what their users want and what works for them. By testing with real people, with real opinions, on real devices in real-world situations, financial solutions can be as agile and unique as the people using them.

No matter where you are in your digitalization journey, our crowdtesting solutions can help you develop solutions that your customers will love.

Social distancing and lockdowns – boosting the cashless society

With non-cash payments expected to hit 1.9 trillion transactions by 202924, consumers are embracing digital solutions. In the UK, a study by payments firm Worldpay predicted that by 2024, cash will only be used in just 6.9 percent of transactions.25 This rapid evolution is creating huge technical and usability challenges for the payments industry.

Payments systems are complex, they have multiple configurations, complex interfaces, undergo constant upgrades and functionality changes, and all demand an elevated level of testing that covers all usage scenarios. The ongoing pandemic, however, is impacting how such testing is conducted. Development and quality assurance teams remain displaced, resources are limited, and the ability to innovate, let alone ensure a secure, workable solution, has become increasingly difficult.

Paradoxically, as ongoing lockdowns remain a constant threat, and organizations look for more flexible and cost-effective testing solutions, remote testing using real people, is proving to be a highly effective solution.

The future truly will be “tele-everything”.