Resilience amid disruption

The insurance industry faces many challenges and disruptive trends but embracing change and focusing on a customer-first approach can build trust and create a competitive edge.

Resilience amid disruption

The insurance industry faces many challenges and disruptive trends but embracing change and focusing on a customer-first approach can build trust and create a competitive edge.

As with many industries, insurance companies are steadily embracing digitalization. But this comes as no surprise. Everyone is steadily using connected online solutions because the benefits are clear. Greater productivity and efficiency, more flexibility in how you work, improved customer experience, and a faster way to innovate.

Executive Summary

Customer demand, in particular, is a substantial driving force to this change, and meeting their expectations requires the continual adoption of innovative technologies. This is expected to see businesses’ technology budgets rise by 13.7% throughout 2022.1 But it is also resulting in the rise of cyber risks such as ransomware and supply chain attacks.2

Such challenges may be increasing, yet digital transformation is essential for any business wanting to stay relevant and competitive. Becoming digital means being more agile and resilient to disruption.

However, while early adopters have quickly improved efficiencies through a range of technologies, those starting their digital journey are faced with a complex and challenging environment. Especially when it comes to updating their legacy systems, which many see as the main obstacle when it comes to digital adoption.3

For CTOs, CIOs, product managers, and digital product developers, being familiar with what is driving this adoption, the challenges they must address, and the technological trends set to shape the industry in the coming years are essential. With that in mind, this whitepaper takes a close look at three themes:

- Digital transformation has multiple drivers. Arguably the most important are customers, who now expect a fully personalized, easy-to-use, reliable, and secure experience on any device and digital channel 24/7/365. Organizations also need to reduce costs and digitalization is an ideal method to streamline, automate, and optimize processes. It can also help meet ESG commitments by enabling the accurate capture of data and use of analytics to show exactly how effective their ESG management is and to see potential trends.

- Challenges are increasing and evolving. From the rapid growth of cyber risks, the need to update legacy systems, to the necessity of delivering an automated, AI-driven experience that doesn’t lose the human touch. The Internet of Things is revolutionizing how people interact with insurers and how insurers can collect data and set policies, but this requires a substantial investment into those technologies. Smart contracts and various crypto assets require increased security and consideration of their potential legal impacts. Then there’s also the challenge of remote working and the need to provide an agile working environment.

- The world, and the industry, are changing fast. Many trends are set to directly impact everyone and will certainly dictate the direction of the industry in the coming years. The metaverse, blockchain, big data analytics, and the cloud. Then there are the various innovative approaches to services, from microservices (utilizing application programming interfaces) to Software-as-a-Service and Digital Insurance-as-a-Service. Even beyond technology, personalization, climate issues, and ethics (reflected in ESG) are growing in importance.

“Once you’ve read our whitepaper, I’m certain you’ll have the insights you need to create optimized digital solutions that your customers and policyholders will love. Let’s build a truly resilient and trustworthy business.”

Georg Hansbauer, CEO & Co-Founder, Testbirds

Personalization – driving the digital future

While the past years have seen a surge in digital transformation throughout virtually every industry, the coronavirus pandemic saw this significantly accelerate. Social distancing, remote working, and the need to cut costs have boosted the adoption of new technologies and updates to legacy systems.

For early adopters, this has given them a clear advantage as they utilize technologies such as artificial intelligence (AI), machine learning (ML), and predictive analytics to drive operational efficiencies and provide innovative solutions. Those who are only starting their digital transformation, however, are facing numerous challenges from non-traditional entrants such as banks and asset managers, tech-savvy insurtech companies (which are expected to grow by about 45% annually between 2022 and 2025)4, and the difficulty of updating their legacy systems, which has been noted as one of the biggest obstacles to becoming a digital-led organization.5

This difficulty is further impacted by the steady rise of new regulations being enacted around the world to deal with digitization, data security, digital assets, and additional concerns, including social and climate impacts.6 But it is the changing expectations of policyholders that are the biggest driver of digital adoption within the industry.

People want interactions to be simple, convenient, seamless, and intuitive. Being able to provide such an experience creates a huge competitive advantage. If customers don’t receive that experience, they can simply go online and search for someone that can deliver what they want.

Every interaction must be about boosting that experience, and this requires intimately knowing the needs, expectations, and pain points of your target group.

Start everything with the user

For decades, companies have set the rules.

This is the policy we provide, that’s what you’ll get. Communication would be rare and often only sales-related, a bill, or an update to their privacy notice.7 Today, this is quickly changing as customer demands increasingly drive what organizations offer, and how it is delivered.

Because people receive highly personalized experiences from other industries, they fully expect the same from their insurers. They want trusted, consistent, and seamlessly connected journeys where their needs are discussed and addressed. To be seen as a valued partner and not just a customer.

Younger generations, in particular, expect customized solutions that can be accessed via different platforms. Real-life interactions aren’t a priority. Today, it’s all about speed, reliability, and convenience.

Can they easily sign up online and have claims automatically verified?

When contacting your support service, are they always on hold waiting for a human advisor?

Or can they immediately interact with an AI-driven chatbot? Even then, the experience must be a positive one. 73 percent of Americans would not use a company’s chatbot again if they had an unpleasant experience with it.8

But, most importantly, it must be personal. Messaging must be targeted, offers and pricing relevant, and everything has to happen at the right time.

In addition to AI and ML-driven automation, this is seeing the industry adopt personalized marketing as a way to provide such highly specific offers. Based on data and analytics, such campaigns can reduce acquisition costs and improve crossselling and marketing return on investment.9

Data is clearly essential when it comes to providing a truly personalized experience.

As is showing, from the top down, that your organization is doing what it can when it comes to environmental and social issues. Such ‘social currency’10 is a vital component in how policyholders and stakeholders perceive your organization.

What matters most to them? Diversity and inclusion, sustainability? Are you making a strong (and positive) stand on similar issues? Can you demonstrate that the way your organization operates is ethical and strives to meet these goals? It’s more complex than just perception, however, it’s becoming a requirement to do business across the world. This will only increase as environmental, social, and governance goals become mandatory.

As KPMG noted: “Consumers are choosing brands for their ethical behaviour and their record on climate change. Investors are favouring businesses with robust ESG frameworks. And governments are implementing regulations requiring organisations to increase transparency in areas such as diversity, equal pay, carbon emissions and modern slavery.”11

This is the primary focus of ESG. Do your part.

In the coming years, this will be impossible to ignore, and that means developing clear ESG strategies, tracking initiatives against specific ESG targets, and gathering the metrics you need to prove you’re doing what you say you’re doing. To demonstrate, through your annual reports and marketing, strong oversight, compliance, and risk management.

The more transparent you are, the more personalized your services, the more trust you will earn, and the better placed you’ll be to tackle tomorrow’s challenges.

Risky business – the challenges facing the insurance industry

The coming year is set to present the insurance industry with a range of significant challenges. Continuing with ESG goals and developing customer-centric solutions are just the start.

This was expanded on in Deloitte’s 2023 Insurance Outlook12, which noted “The road ahead is dotted with multiple hurdles – rising inflation, interest rates, and loss costs; the looming threats of recession, climate change, and geopolitical upheaval; and competition from insurtechs and even noninsurance entities such as e-tailers and manufacturers, to name a few.”

Reinsurance capacity, in particular, is set to face a sharp decline.13

Digitalization will be an essential tool in helping insurers build their resilience to such challenges. But it also comes with its own issues. One of the biggest is modernizing and replacing legacy systems and removing data silos.

Don’t leave a bad legacy – the need to modernize

Flexibility is essential, and legacy systems, especially the policy administration system14, are proving to be a roadblock when it comes to insurers fulfilling their product strategy and objectives. Can you quickly bring products to market? Change them as required? Can your system use analytics or enable a positive, personalized digital experience? How well can you automate services and improve efficiencies?

Updating legacy IT systems is essential. Customers demand more and want to engage with a range of modern devices and services across digital channels, such as Insurance-on-demand and Internet of Things (IoT) devices. Additionally, as noted by LexisNexis, insurtechs and other tech-savvy startups “are seeking to disrupt various parts of the traditional insurance value chain, including the smart home and other augmented risk services, from claims processing, pay-as-you go services for motor insurance, to photo recognition, to social proof and crowdsourcing for insurance products.”15

A modernized system ensures you can deliver flexible, customer-oriented solutions. Where, when, and how they’re needed. And often, without the need for human input.

Let the machines do the talking – optimization with artificial intelligence

The use of AI, ML, and data analytics is quickly being adopted by the insurance industry and presents a massive US$1.1 trillion in potential annual value.16 Late adopters will be at a distinct disadvantage.

If a task is common, routine, and repetitive, workflow automation utilizing AI and ML can take care of it, and where there is missing or conflicting information, a human agent can take over while the AI learns from what the agent does.

Such deep learning is set to radically change many services and functions, and will, as noted by McKinsey see insurance “shift from its current state of ‘detect and repair’ to ‘predict and prevent’, transforming every aspect of the industry in the process. The pace of change will also accelerate as brokers, consumers, financial intermediaries, insurers, and suppliers become more adept at using advanced technologies to enhance decision making and productivity, lower costs, and optimize the customer experience.”17

There are multiple areas set to benefit the most:

Claims management and underwriting

The more that people are connected (cars with connected telematics devices, smart home assistants, fitness trackers, etc.) the more data can be collected and analyzed by insurers – including remote inspections. AI algorithms can then quickly and efficiently scan all incoming data and help provide faster settlements and determine risk in real-time.

Fraud detection and prevention

In America alone, insurance fraud (not counting health insurance) costs the industry more than US$40 billion each year18. That’s a clear incentive to quickly detect fraudulent claims. With AI-powered fraud detection utilizing deep learning, machine learning, and predictive analytics, concerning patterns can be quickly identified, suspicious behavior noted, and reduce the number of false positives.

Customer service and support

Virtual assistants and chatbots utilize AI-powered natural language processing to deliver information and assistance in an increasingly human-like manner, 24/7/365. A chatbot can answer questions about policies, while the virtual assistant (which is more advanced and interactive) guides a customer through a claim. By efficiently and accurately taking over mundane tasks from insurance agents, they can free up employees for more strategic tasks, provide consistent brand messaging, improve customer satisfaction, and a lot more.

Always play it safe – dealing with the rise of cybercrime

In many ways, today’s technology revolves around the collection, storage, transmission, and analysis of massive amounts of data; much of it highly personal. This makes it an unbelievably valuable commodity and a prime target for cyberattacks. As insurers continue their digital transformations, this will become an ever-bigger issue – between 2020 and 2021 alone, there was a 50% increase in overall attacks per week on corporate networks, with insurance/legal seeing a larger rise of 68%.19

Such attacks can range from attempts to gain personal data such as passwords and login credentials (phishing), infecting and gaining access to networks and personal computers (malware attacks), and threatening data with public release or destruction if money is not paid20 (ransomware attacks). Cybercrime can also include digital fraud. Between Q2 2021 and Q2 2022, global digital fraud attempts that specifically targeted insurers increased by 159 percent21 with first-party application fraud rating the highest. And as connected solutions increase, attacks are also being made on smart sensors, in-car telematics devices, and anything else that connects to the internet. For insurers looking to utilize sensors to track how someone drives, or to see if they’re exercising and staying healthy, protecting that data – and all data – is essential. Data breaches can result in loss of trust and potential legal action.

As PwC notes in their 2022 Global Digital Trust Insights Survey22, “The consequences for an attack rise as our systems’ interdependencies are becoming increasingly complex. Critical infrastructures are especially vulnerable. And yet, many of the

breaches we’re seeing are still preventable with sound cyber practices and strong controls.”

This includes improving technologies and policies, providing adequate user training, and conducting consistent and thorough testing.

Structured Bug Testing

Make sure the core functions of your digital product are bug-free. Let the Crowd test it step-by-step according to detailed use cases.

Find out moreDigital insurance – the trends changing the industry

The convenience that customers receive via digital solutions is obvious, and the demand for such solutions is increasing. In a pre-covid 2019 German study (of 1003 German insurance customers), 55 percent had purchased an insurance product online at least once. For those aged thirty and under, it was 65 percent.23

It’s a clear indicator that using online services to find insurance is steadily gaining in popularity. This was seen as the pandemic continued throughout 2020 into 2021 and online solutions became essential: A 2021 Deloitte survey of insurers showed that 95 percent had (or were looking to) accelerate their digital transformation, while 40 percent expected to increase their investment in direct online sales.24

More agile technical solutions, holistic data management systems, cloud-based infrastructures, application programming interface (API) layers, and more, will be necessary to create a more resilient and competitive business. Doing so can improve operational efficiencies and speed to market, create a better customer experience, and boost data and analytics capabilities. And ensure your organization is ready to tackle today’s challenges, build resilience, and take advantage of tomorrow’s trends.

Secure underwriting – the blockchain advantage

When it comes to addressing risk areas such as fraud prevention, smart contracts, claims management and automated underwriting, and data decentralization, blockchain technology holds much promise across the entire value chain. As defined by IBM, a blockchain ‘is a shared, immutable ledger for recording transactions, tracking assets and building trust.’25

On the business side, blockchain can provide a highly secure, fully transparent solution that builds trust. Blockchain’s data is completely decentralized and cannot be manipulated by a single entity, there is always continuous replication. Customers can enjoy faster onboarding and claims management, while knowing that their data is secure, won’t need to be re-entered, and is fully encrypted.

Smart contracts stored on a blockchain, in particular, are set to become the new standard. As self-executing programs that can track claims, transfer payments, and update conditions without human input or the need for a paper trail, smart contracts will streamline insurance policies and make transactions far more transparent and trackable.26

Connect the dots – how the Internet of Things is changing insurance

With the number of IoT devices around the globe expected to increase from over 16 billion today to more than 30 billion by 2025,27 it’s clear that individuals and businesses are embracing such connectivity. Used in cars, homes, industry, wearables, and much more, IoT devices for insurance will provide a range of opportunities to manage risk.28

For health and life insurers, they can directly track user activities and monitor behavior. Car insurers can check the condition of a vehicle and how it is being driven. Property insurers can connect to smart homes and see that security systems are working. Smart drones can access hard-to-reach and dangerous places to assess any damage.

Such IoT devices can help insurers create innovative and highly personalized insurance products that focus on optimized risk prevention, and not just risk coverage. By taking on a more proactive, preventative role, insurers can deliver more value to their customers and create a better overall experience.

Put the customer first – using APIs to deliver tailored solutions

Outdated legacy systems and siloed databases are impeding business growth and simply cannot keep up with customer demand for fast, efficient, connectivity. Importantly, they are also impeding the transfer of valuable data. This is why, for any insurer looking to quickly boost their digitalization and agility, application programming interfaces are essential. Acting as a gateway, APIs enable the flow of information between disparate technologies and applications.

This helps to ensure more agility while enabling and enhancing the omnichannel experience; especially around IoT, mobile, and online services.29

Through APIs, insurers can improve their speed and efficiency to better react to changing customer demands and expectations, and power their omnichannel capabilities to deliver relevant data to their policyholders, brokers, agents, and partners. They can also build new business opportunities by enabling easy collaboration with other companies and industries.

And when combined with microservices, APIs provide a truly seamless customer experience. By breaking down applications to their core functions, microservices use an API to treat that function as a single, self-contained service, which is ideal for future-proofing, creating new revenue streams, scaling and/or re-using operations, and providing more personalized products and services.

The more everyone connects, the more data will need to be shared, and that means APIs are set to be the default communication channel.

It’s all in the details – the ever-growing benefit of big data analytics

If you’re not a data-driven business, and well on your way with digital transformation, you’re at a huge disadvantage to competitors who are. The right data, and its analysis, ensures you can accurately assess risk and calculate premiums, detect and prevent fraud, cut costs, create more efficient processes, and intimately know your customers so you can deliver a hyper-personalized service that promotes customer retention.

Powered by digital technologies, we can now gather massive amounts of data, and not just the usual structured data like their age, gender, and medical history, but data from a vast range of data points (non-structured data) including social media activity, shopping habits, and information gathered from IoT devices.

All of this data can then be analyzed to provide a far more holistic view of customers than ever before and help you to provide personalized offers, make faster claims, identify potential risks, manage them in real-time, predict their lifetime value, and more. It is also highly beneficial when making usage-based policies. Consider in-car telematics. Once the sensors send you the data, you can gain a much clearer picture of how someone actually drives their car (not how they say they drive) and make appropriate offers. IoT data can let you see if customers are exercising (for lower premiums) or if a business is consistently locking its doors.

Even though the insurance industry has used data for generations, it is only now that its full potential can be realized, as noted in YFS Magazine, “Big data implementation results in 30% better access to insurance services, 40–70% cost savings, and 60% higher fraud detection rates, which is beneficial for both insurers and stakeholders.”30

Change the channel – embrace a multi-channel approach

The insurance industry, as with most others, is being propelled into the digital world by changing customer behavior. The internet, connected smart devices, mobile apps, and the cloud, all enable convenience and immediate access to content, products, and communication.

When shopping online, customers can receive near-instant gratification. Wherever they are, they can stream their favorite shows to a handheld device. They can use smart devices to control the lighting, heating, and cleaning in their homes. Their experiences are personalized, highly convenient, and reliable. It’s no surprise they’re increasingly expecting this from insurers. Rather than one point of contact at a set time, they now expect multiple, and flexible, access points.

Being able to provide such a seamless service means embracing a multi- or (preferably an) omnichannel approach.31 With multichannel, you can utilize multiple channels (website, app, phone) but they are typically not connected and tend to focus on a product. Omnichannel connects every channel, revolves around the customer, and provides a consistent experience regardless of how they interact with you.

Ultimately, such online channels (when done well) encourage more engagement with their insurers. For tech-savvy customers (and agents, brokers, and partners), this will typically involve using their mobile solutions. For insurers, this will require an investment into developing features for those devices, from e-signatures to mobile app security.

Behind the scenes, however, significant changes must be made. All data channels must be synchronized, suitable strategies developed (such as enterprise data management), customer engagement programs must consider higher levels of complexity, customer journey maps need to be made, KPIs identified, and much more.

To get this right, McKinsey proposed three approaches32 (based on existing strengths and organizational capabilities) to adopting a multi-access approach:

- Digitization of the existing agent channel

- Full integration of agent and direct channels

- Enhancement of direct channel with human components

The result should enable effective data collection and analysis so real insights can be made based on actual customer behavior, which drives product development and the delivery of personalized experiences.

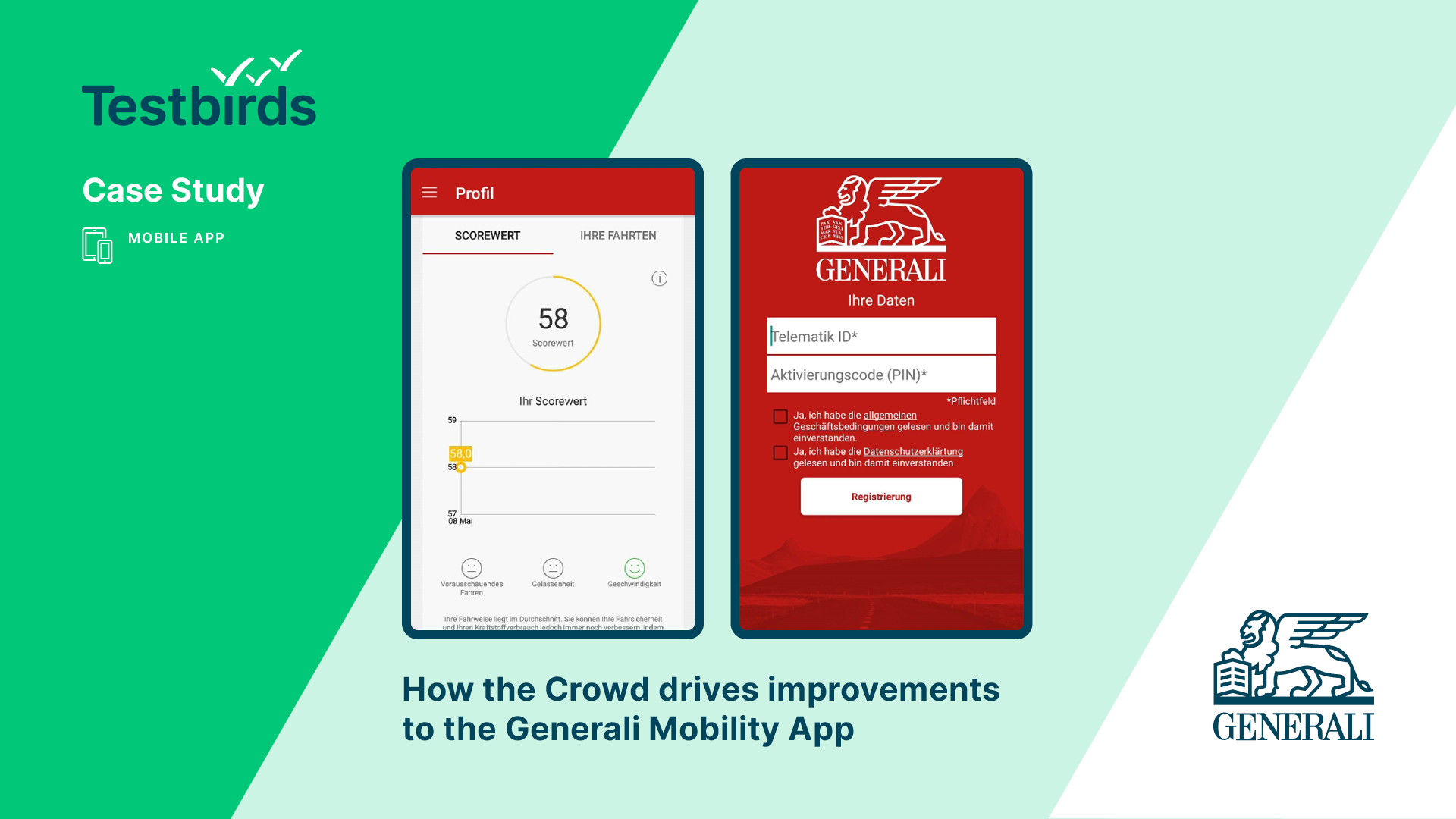

The Crowd helps improving the Software: Testing the Generali Mobility App

Building trust and resiliency

A resilient business is essential to withstand any number of changes, whether known or unforeseen. Building this resilience takes a significant investment in innovative technologies, including blockchain and the Internet of Things, and putting effort into the best ways to provide a highly personalized service (not just a superior product).

Those who are agile and change-ready, while being able to deliver a fully connected and consistent best-in-class customer experience will gain, and retain, more customers. But trust comes from developing digital-enabled solutions that reliably meet a wide range of needs, as the customer wants, and when they want them. This is where testing is so essential.

To discover pain-points and see what works and what doesn’t at every touchpoint, Customer Journey Testing looks at every aspect of your solution. There are times, however, when it’s best to take a closer look at, and thoroughly test, the usability and user experience. Does your digital solution actually deliver what it promises? Do links work? Is everything logic and easy-to-find? You can also enhance that with localization testing to ensure everything is understandable and appropriate for your increasingly global customers.

Getting it 100% right, however, means taking your solutions out of the lab and using real people to test in real-world situations. Only then can you be certain it’s user-friendly, reliable, and works on any device or operating system while having no bugs, no security concerns, and no functional issues.

As the world rapidly changes, and consumers want it all, getting these right builds trust and delivers a truly resilient competitive advantage.