VR Smart Finanz -

Holistic commercial user experience testing

With crowdtesting, Testbirds helps clients optimize the UX

and QA of digital products, from apps and websites to IoT applications.

“We chose Testbirds because we felt supported professionally and cooperatively from the very beginning. With the solution-oriented consulting during the test design, we were able to receive feedback in advance of strategic decisions, as well as test specific further developments of our digital services and completion process.”

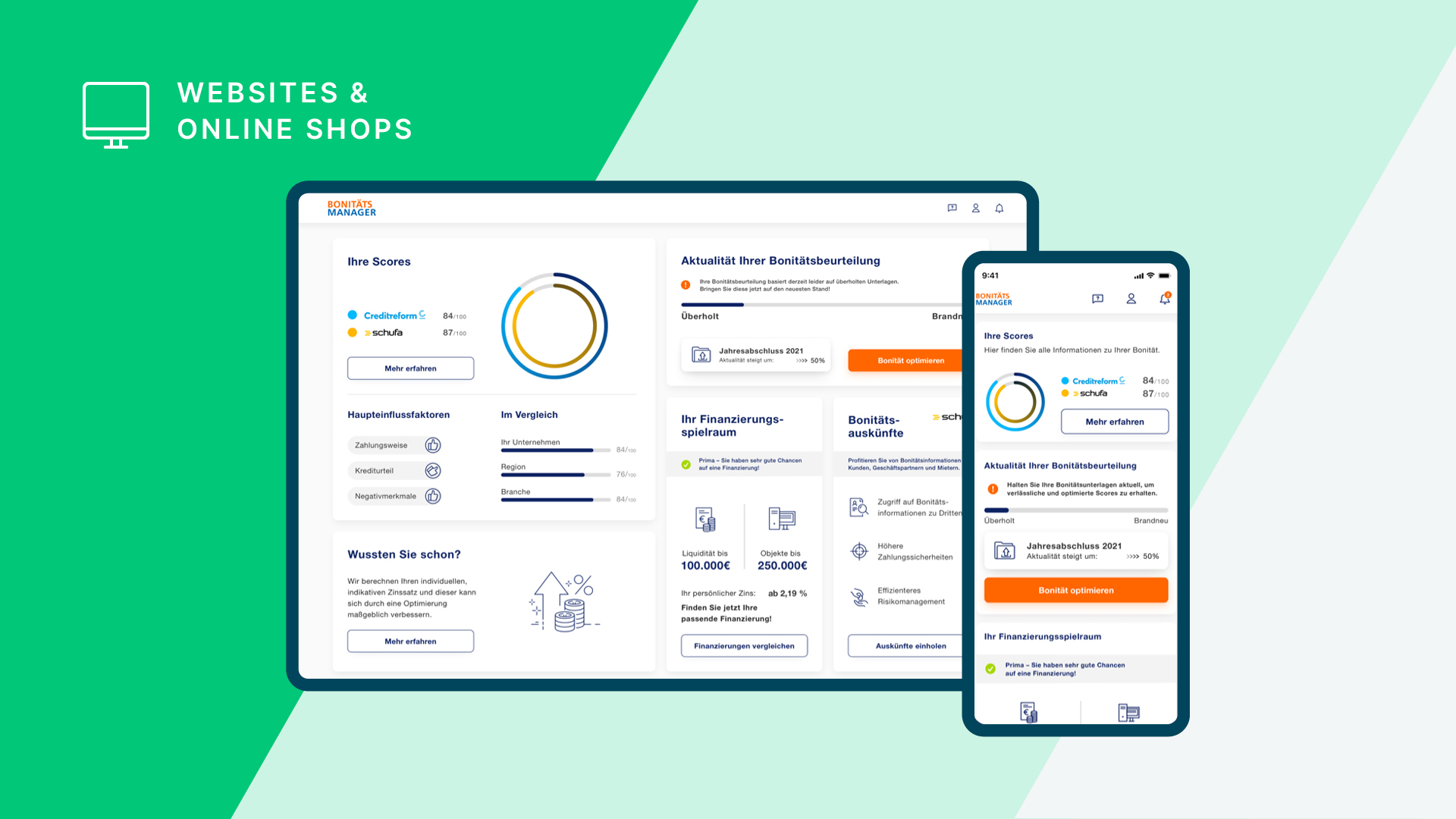

Digital completion process | VR Smart Guide | Bonitätsmanager

VR Smart Finanz conducted several UX tests with Testbirds in various areas as part of a cross-departmental project to meet the high-quality standards of a mature user experience (UX) for its financing solutions. The goal was to put their digital solutions to the test in order to better adapt them to the needs of their customers.

VR Smart Finanz

As part of Volksbanken Raiffeisenbanken, VR Smart Finanz supports regional SMEs as well as business and commercial customers of cooperative banks with simple, fast, and customized financing solutions. The range of services includes solutions for leasing, lease-purchase and loans, as well as digital services on all aspects of everyday finance.

With their digital solution network, VR Smart Finanz supports Volksbanken Raiffeisenbanken’s customers across the entire value chain at every point of their customer journey. The company‘s particular strength lies in accurate, digitally supported financing decisions in real time via an online completion process on the Volksbanken Raiffeisenbanken website or in personal consultations on site. VR Smart Finanz’s digital services enable corporate customers to conclude business loans entirely digitally via the website of their selected Volksbanken Raiffeisenbanken, as well as cover their daily financial business needs relating to topics such as accounting and creditworthiness.

Sustainability is an important part of VR Smart Finanz’s business strategy and this entails assuming active responsibility. The company takes this responsibility seriously throughout its business activities and is guided by cooperative principles and values.

To meet the high-quality standards of a mature user experience (UX) for its financing solutions, VR Smart Finanz conducted several UX tests with Testbirds in different areas within a cross-departmental project. The focus was to test further development of their digital solutions to better adapt them to the needs of the customers.

Client’s needs and test setup

With crowdtesting, Testbirds helps clients optimize the UX and QA of digital products, from apps and websites to IoT applications. For VR Smart Finanz, the Testbirds services Unmoderated Usability Test, Moderated User Sessions, Quantitative Usability Test, Usability & UX Test and Comparison Study were conducted within the different tests in the overall project.

Over a period of seven months and six different tests, a total of 122 testers worked on 20 use cases – 16 of which included video. In the process, 23 closed and 16 open questions were answered. In addition, 13 testers went through a 30- to 45-minute interview, which consisted of both open questions and a prototype evaluation.

Service Designer, Omnichannel Customer and Banking Interaction at VR Smart Finanz

“Thanks to the uncomplicated and quick execution of an unmoderated usability test, we were able to obtain valuable feedback from our relevant target group. In the process, we received constructive and practical suggestions for improvement, especially for the start and end of our customer journey.”

The client’s requirements for the individual tests within the overall project varied in nature, but all were aimed at optimizing the usability of their digital products and deriving new service ideas based on the target group feedback.

The goal for the digital application and completion of the entrepreneur loan was to gain overarching insights and, more importantly, a detailed understanding of the journey.

For the digital SaaS solution VR Smart Guide, the primary objective was to gain insights into the core billing function in order to reduce churn and increase retention through the planned overhaul of the service. As part of a retest, the implemented optimizations were tested for usability again a few months later.

In testing the account check, the main overarching questions sought to clarify the account check within a credit application and the associated entrustment of personal data. For the prototype evaluation of the account check, 15 testers participated in a two-part study, consisting of an interview and a click-dummy evaluation.

For the credit check (Bonitätsmanager), a test was carried out comparing the old software version with a new version. The aim of testing the new user interface was to find out how the new version would be received by the target group and what adjustments were needed to be made before launch.

Aside from testing the UX of their digital services, feedback was obtained from the target group on planned activities relating to sustainability, ESG, and potential service ideas in the ideation stage.

A special requirement for all six tests was that they should be carried out exclusively with crowdtesters in the commercial sphere in order to best represent the target group of commercial customers, SMEs, and the self-employed.

Testers included sole proprietors of various corporate forms, management consultants, tax advisors, insurance brokers, IT consultants, and farmers. The selection of testers was based on the criteria specified by VR Smart Finanz in the Testbirds Nest, where testers can be filtered and selected by the project and crowd managers based on a wide range of demographic information. Information on professions can already be found within the completed tester profiles. Further project-specific information, for example regarding corporate loans, was obtained by means of preliminary surveys to narrow down the final selection of testers.

Head of Omnichannel Management, Trends and; Cooperations at VR Smart Finanz

“The collaboration with Testbirds was very constructive and solution-oriented. The swift implementation from the initial meeting up to the joint test results discussion was very helpful. In addition, we were able to conduct several tests in parallel without losing momentum.”

Results

The tests provided VR Smart Finanz with detailed usability feedback on a wide range of digital solutions and inspiration for future developments in a very short time.

While the digital application and completion process for the entrepreneurial loan was already user-friendly and easy for the testers to go through, they wished for more information and clearer communication of the required key company figures at various stages.

Core results of the test for VR Smart Guide‘s invoice generation function were mainly about intuitiveness and improvement of clarity, which were subsequently validated in a retest. With the help of crowdtesting, it was possible to increase the System Usability Scale (SUS) Score of the invoice creation from good in the first test to very good (SUS Score > 82) in the retest. In addition, concrete feedback was given on which application features should be developed further in the medium term in order to increase retention.

Regarding the account check as part of the financing decision, VR Smart Finanz received valuable insights on how best to design the process to increase user trust and mitigate concerns that the account check would have a negative impact.

In addition to specific suggestions for improving intuitiveness, the testing of the new interfaces for the credit check (Bonitätsmanager) concluded that the new design is preferred across the board, but that there is still room for optimization, especially in terms of color design.

In the interviews on sustainability topics, which were kept deliberately open, specific concerns of testers who are self-employed were raised in relation to the implementation of future ESG specifications that could be addressed with targeted support. As a main result of the test, tangible recommendations were provided on how and in which context potential service ideas could add further value.

Overall, the combination of different UX tests at different stages of product development provided valuable insights for optimizing digital services based on real user feedback. All tests took place in the prototype, market launch, or concept phase, enabling VR Smart Finanz to integrate insights gained in the early stages of product development, thus saving a lot of time and resources.

“With the support of Testbirds, we were able to test the main user flow in our application with real users in several iterations without having to develop a single line of code. The lessons learned led to a concept that halved the time spent processing tasks in the testing process and of course saved relevant resources.”

Comparison Study

Thinking about an A/B test? We have a better solution with real outcomes on your KPIs. Find out what your users prefer and most importantly – why!

Find out moreWe provide you with the latest insights from the world of crowdtesting

Stop guessing if your product meets your users' expectations and start making decisions based on facts.