What an amazing 4 days we had at this year’s Mobile World Congress (MWC) in Barcelona.

Our crew Julia, Caro, Carl, and Stefano flew to the Fira Gran Via and exhibited alongside other Bavaria-based companies. We met some great companies at our booth and were impressed by all the interactive and immersive booths at MWC.

Two of the most impressive were by South Korean telecommunications companies. SK Telecom showed off their futuristic air taxi service, which they aim to debut by 2025, while KT provided a 3-sided experience zone AI.

Key topics around manufacturing and mobility, finance and fintech, the Metaverse and gaming, were explored at the various sessions we attended.

Connectivity in manufacturing

We heard from Jennifer Artley (Verizon Business) and Adolfo Hernandez (Amazon Web Services) at the Manufacturing Summit: Enabling the new era of industry with purpose session.

They shared their use of connected industry solutions, such as a combination of 5G, cloud, AI and IoT, to transform their companies.

In particular, Adolfo Hernandez highlighted how “the marriage between connectivity and the cloud is a marriage made in heaven”, while Jennifer Artley mentioned that the key challenge today is “operational technology teams [that] want to make the change … have to come together with IT [teams]”.

We also heard from Mohannad Makki (stc), Thomas Mueller (Wipro), and Katharine Shaw-Paffett (Microsoft) at the session on Is there anything that can’t be connected?, where they explored the latest innovations in connected IoT, space, and education.

Mohannad Makki highlighted that consumers today want to be connected to each other and also with connected devices, while Katharine Shaw-Paffett shared her belief that “we should connect everything”.

Thomas Mueller shared how so-called software-defined products can be more sustainable, as many capabilities in such products can be amended and changed over many more years of the product’s lifecycle.

World premiere

We were especially excited to be to be at the world premiere of VW Group’s new in-car application store for Android, jointly developed by CARIAD and HARMAN, at the Smart Mobility Summit: Travel Beyond Cars.

As part of all new Audi vehicles launched from this July, this new Android app store will provide drivers with the opportunity to upgrade their cars with new functionalities. This will help ensure that cars keep up with the fast-changing digital world, as mentioned by Dr. Riclef Schmidt Clausen (CARIAD), who argued that cars are increasingly about software and the user experience.

This world premiere was followed up by a panel talk on Open Ecosystem – Enabling the best customer experience, where Björn Wischnewski (Audi), Tyler Steben (IBM), Mithun Baphana (Cisco), and Sven Eckoldt (CARIAD) dived into this new automotive product.

Björn Wischnewski shared how Audi listened carefully to their customers’ feedback on their desire to have “their personal digital ecosystem integrated to their cars”, so they could “use their favorite apps and services while being in the vehicle”.

Instead of continuing with “one-to-one integration” with third-party apps, Audi decided to develop their own app store that allows them to “bring a much broader variety of services and apps” to their drivers.

Mithun Baphana shared how customers now “want to work from their car”, and how Webex set about transforming Audi cars, when parked, into personal conference rooms.

The future of fintech

FinTech was one of the five major themes of MWC, and we attended the Breaking down fraud hybrid session with Blair Cohen (AuthenticID), Sulabh Agarwal (Accenture), Seth Gilpin (Telesign), among other speakers.

This session explored the various tools and technologies to fight scammers, reveal synthetic identities and counter money laundering.

The importance of these new technologies to protect the future of finance was emphasized by Sulabh Agarwal.

Protecting the future of finance with new technologies is all the more important given the explosive growth of fraud, at “about 25% over the last 10 years” and now requiring “about 8-10% of an organization’s revenues” to tackle this issue, according to Sulabh Agarwal.

Two suggestions were made to fight this growing rate of fraud. One was the “move beyond just confirming data” and instead companies need to “figure out the ‘who’ behind every transaction”, as suggested by Blair Cohen.

The other was “self-sovereign identity”, as mentioned by Seth Gilpin, though he believed that “we’re not quite ready there any time soon”.

Another insightful session was Let’s disrupt fintech with Ernest Sánchez (Nuclio) and Sophia Bantanidis (Citi Global Insights).

The changing fintech landscape was explored by Sophia Bantanidis.

She compared the adoption cycles pre- and post-internet, and highlighted the growing “pace of technology innovation” and “new business models and platforms that are really easy to join and reaching 50 million users in only a few number of years”, citing the example of ChatGPT reaching millions of users in just its first week.

This session also explored how innovations are set to revolutionize the fintech ecosystem, with Ernest Sánchez highlighting the symbiotic relationship between fintech start-ups and traditional banks. He observed that “fintechs are working with banks more and more”, as traditional banks realized that fintech start-ups are no longer “just tackling small tasks of the ecosystem”.

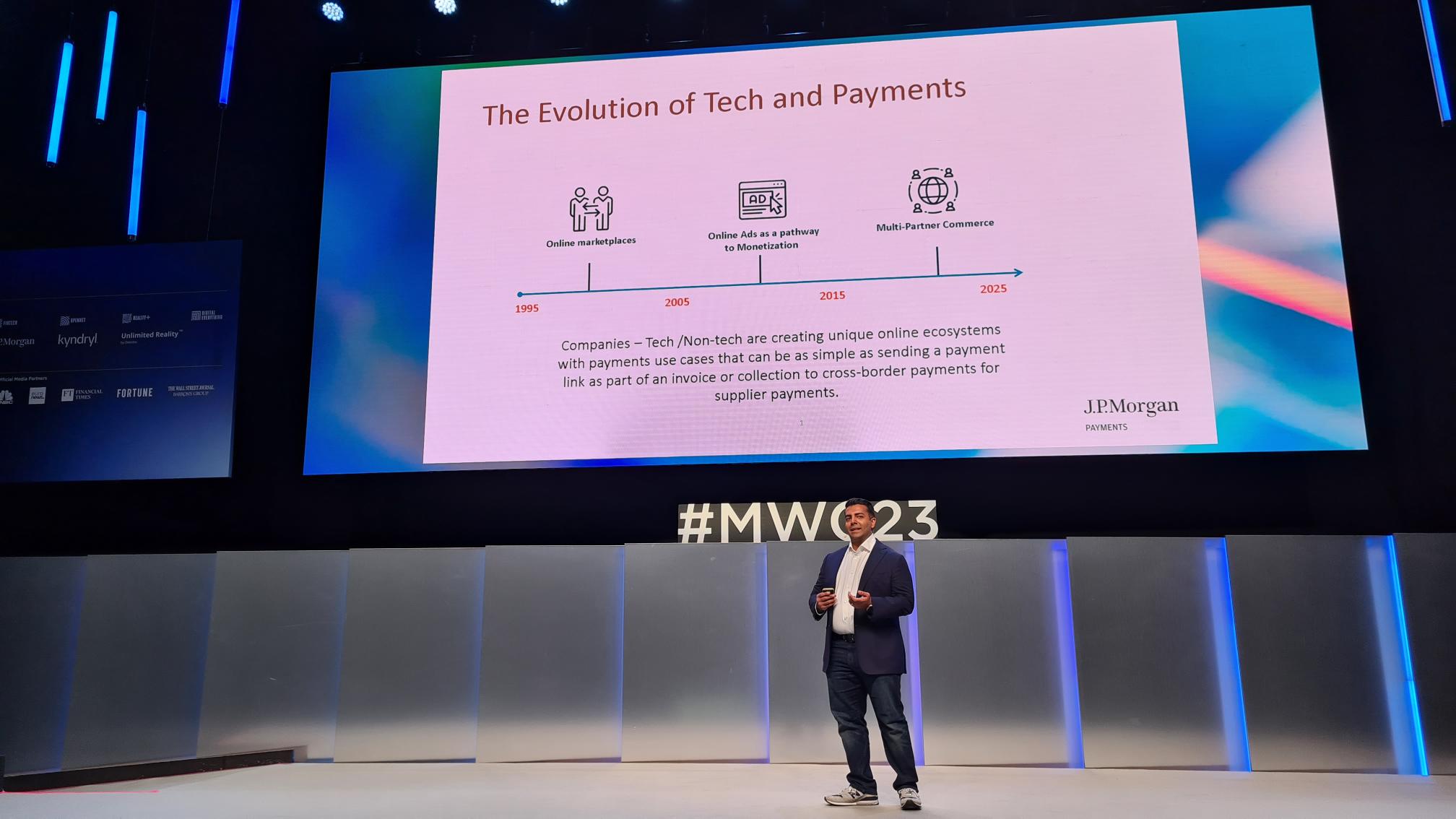

Embedded finance

A big highlight for this FinTech theme was the session Is embedded finance a win for all? with Nazim Ali (J.P. Morgan), Irfan Wahab Khan (Telenor Microfinance Bank), and Mariam Cassim (Vodacom Group).

Embedded finance is emerging as the next big topic in fintech, with the potential of this new trailblazing trend to ensure “financial inclusion is really a right”, according to Mariam Cassim, particularly for previously excluded areas like Africa.

Yet Irfan Wahab Khan cautioned against getting “carried away with all those opportunities that technologies bring” and focus on people, human-centered design, and the user experience when it comes to embedded finance products.

This focus on users and UX certainly applies to payments, which are expected to be more seamless and frictionless, with Nazim Ali emphasizing how users “expect less friction in today’s always-on and always-something-to-do world”.

The digital utopia of the future

We couldn’t miss the session on The F-word of Metaverse: Future, Fad or Fraud? with Leslie Shannon (Nokia) and Alvin Wang Graylin (HTC), where they explored the future of the Metaverse and how it could redefine the world, people, and business.

Leslie Shannon shared the possibilities of the Metaverse, highlighting the important social role that the Metaverse could play will, as users “go into the digital world to meet more people” and “find their tribe wherever in the world they may be”.

Alvin Wang Graylin cited the “lack of quality content that people can use every single day” as the biggest challenge to overcome for further adoption of extended reality (XR) and the Metaverse. He mentioned that every existing website and app needs to be “created for the Metaverse”, and how “generative AI” would allow us to “do that in 1/10th or 1/100th of the time” needed to do it manually.

A big part of the Metaverse currently is gaming, which was explored in the session Player One, are you ready? with Joao Kluck Gomes (NVIDIA) and Thomas Dexmier (HTC).

While the Metaverse could keep gamers in the digital world, allowing players to, according to Joao Kluck Gomes, “be in the games, playing together”, there is also a “massive trend for people wanting to get out of the house, and go gaming together in location-based venues”, according to Thomas Dexmier.

Only time will tell if the Metaverse will meet its potential as a space for socializing and gaming.

Unleash tomorrow’s technology by testing with real people

From gaming in the Metaverse to connecting digital products and in-car software, the possibilities are endless for tomorrow’s technology.

What is certain though is the need to test new digital innovations, both old and new, in the real-world, with real people, to ensure their user experience is as good as the technology.

After all, it’s all about the people.