The insurance industry is facing unprecedented disruption and change, driven by technological advancements, shifting consumer behavior and expectations, and evolving regulatory landscapes.

In response, many are expanding into new areas of business, adopting new business models, embracing innovative technologies and taking on more risks. Even a quick look at various insurance conferences, such as Digisurance in Berlin, shows how tech is driving amazing changes. However, this new approach isn’t without its challenges, as insurers must navigate complex regulatory frameworks, address cybersecurity concerns, and balance risk and reward.

We’ll explore the insurance industry’s journey into several new frontiers and the challenges it faces within each as they try to better target these markets and their customers – to cover all the bases.

Embracing calculated risk

Insurers who are willing to take calculated risks and embrace new technologies and business models can position themselves for success in a rapidly evolving industry.

However, while many feel the industry isn’t moving fast enough (as was noted in a recent US study, which showed that “63.3 percent of young insurance agents believed that the industry has been too slow to adopt new technology”), this is already changing.

Let’s look at the top 8 areas that are set to transform the insurance industry in the coming years.

AI in customer contact

The use of artificial intelligence (AI) is booming in virtually every industry, and it’s no different for insurers. Many are already adopting these technologies, such as ChatGPT and other generative AI models, to enhance their customer experience, and it’s clear why.

Both can analyze customer data and provide personalized responses – in the form of text, audio, video, and images – to enhance the customer experience and improve customer satisfaction. They can also handle a high number of customer inquiries simultaneously 24/7 days a week, which improves efficiency and reduces costs, while also being able to quickly scale up or down depending on demand. When people expect a fast answer to inquiries (at any time), this is essential.

This isn’t to say there aren’t risks when using such solutions. AI may not always provide accurate responses, and this can lead to errors and customer dissatisfaction. Insurers must also ensure that their customer’s data is protected and not exposed to external threats or unauthorized access – and this also means being compliant with various laws, such as GDPR.

Arguably, the biggest challenge is to ensure that the AI is as human-feeling as possible and that customers don’t feel they’ve lost the emotional connection between themselves and the insurer. This is an important area where ongoing testing with real people can make a substantial difference.

Sales enablement

A team is (usually) only as good as their tools, resources, and the data they have. This is why the use of technology to power insurance sales enablement is becoming increasingly vital to improving sales’ effectiveness and efficiency.

From VR training, gamification, online training, performance tracking, CRM software, AI-powered chatbots, to digital sales enablement platforms, and more, today’s technologies enable insurers to better meet highly specific needs and goals. With the right technology, sales reps can have immediate access to detailed product information, real-time pricing and quoting tools, and personalized recommendations that are based on customer data (which can help them to tailor their approach and build stronger relationships with customers).

Getting this right, however, is a significant challenge. As with all software implementations, integrating with existing systems can be difficult, ensuring data accuracy and security is vital, and being able to maintain the quality of your content is necessary (and this certainly becomes more complicated as content needs change over time).

Developing a solution that is not only useful, but that is used, is complicated. Careful planning, in-house training (that ideally boosts adoption), integration, and testing, are essential.

Embedded insurance

The integration of insurance products into other products is gaining in popularity for insurers who can quickly increase sales and forge lasting partnerships with other industries.

For example, some home security and automation companies offer embedded home insurance to cover things like theft, damage, and liability related to home security systems and smart home devices.

A car manufacturer can offer embedded auto insurance as part of their sales process, which covers things like liability, collision, and even usage-based insurance, which uses a telematics device to track driving behavior.

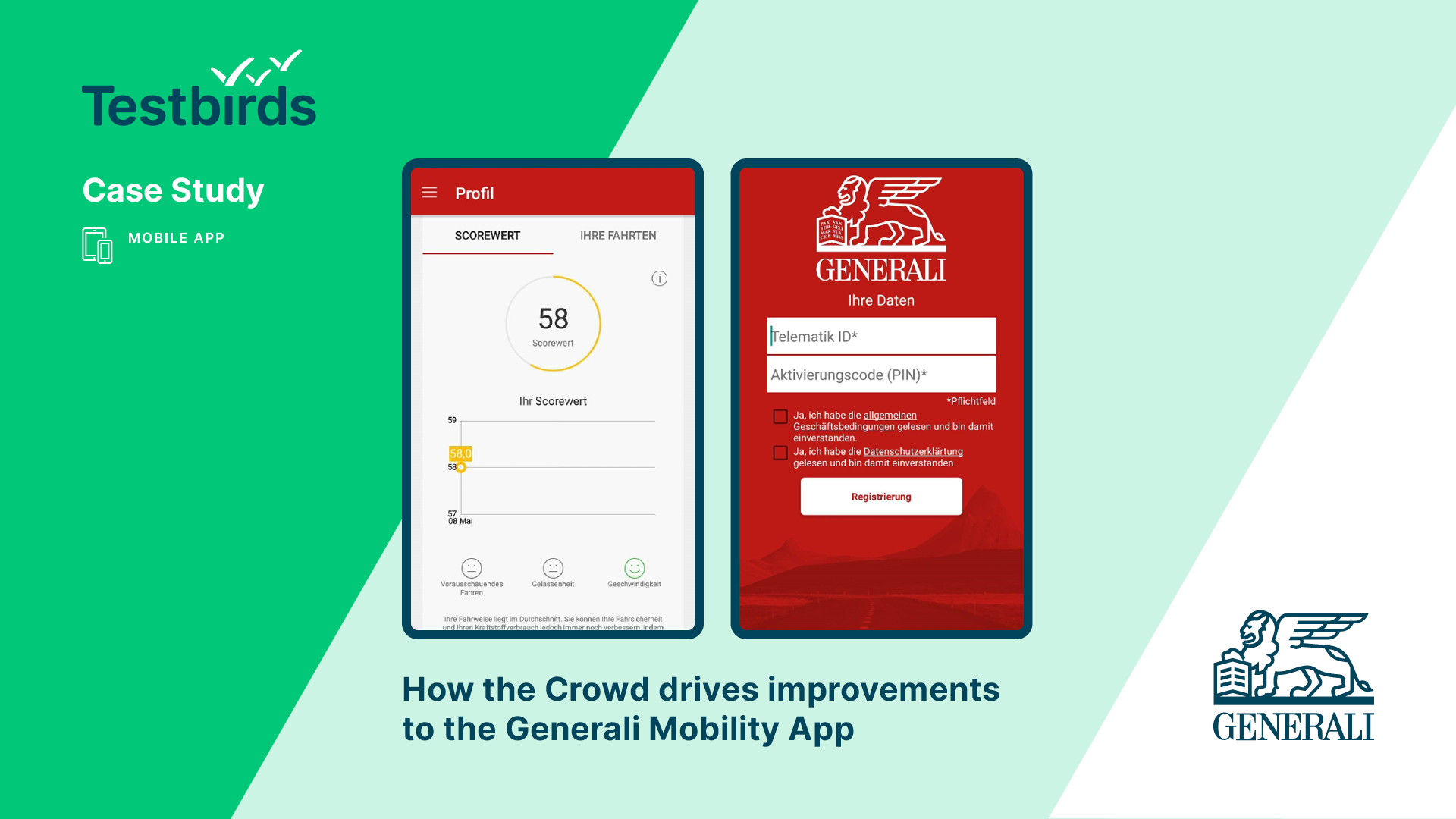

Crowdtesting Generali's telematics smartphone app

And the list is constantly growing. For insurers, this is a good thing as it increases their customer reach and helps to enhance the experience by providing a more seamless and convenient way to buy insurance. All of which can lead to better risk assessments and increased sales.

But, as with all things related to software, there are risks. Insurers may face challenges in integrating their products and services into non-insurance products, which can result in inefficiencies and increased costs. And because embedded insurance involves the collection and use of sensitive customer information, this can raise security and privacy concerns.

Behavioral insurance

Also known as “behavior-based insurance” or “usage-based insurance”, behavioral insurance uses technology and data analytics to collect information about a policyholder’s behavior, such as driving habits or health behaviors, to determine insurance premiums (and to also encourage policyholders to make healthier choices and reduce risk).

Not only can this enable insurers to offer highly specific products based on behavior, but the collection of data can improve their risk assessment and pricing models, which leads to even more accurate and personalized products. And, naturally, identifying and reducing certain risk behaviors can lead to lower claims costs and increased profits.

For customers, however, there are issues (beyond the usual suspects – data privacy and security, and regulatory compliance) around customer perception and ethical concerns. Many people are wary of being monitored and/or sharing highly personal information, which can impact how well an offering performs. Additionally, there may be concerns related to fairness and discrimination. Using real testers to gain real-world feedback about what concerns them can help insurers develop solutions and strategies to better combat these challenges.

Data-driven insurance

Data-driven insurance, also known as “big data insurance”, refers to the use of data analytics and artificial intelligence to analyze large volumes of data to inform insurance products, services, and pricing. For insurers, analyzing such large volumes of data can improve risk assessments and better identify and reduce high-risk behaviors. When combined with AI, it can also improve operational efficiency and reduce costs. But importantly, it can help improve customer engagement and retention by providing a much clearer picture of customer behavior and preferences.

There are, however, several significant challenges. Data must be accurate and unbiased. Ethical concerns regarding privacy, fairness, and discrimination will need to be addressed, and (as always) data privacy and security must be foolproof, which is all possible with adequate testing across a wide range of different devices and environments.

Deliver a premium digital insurance experience

Creating positive experiences through intuitive, simple, and secure digital products can build trust and loyalty among your policyholders.

Learn howGreen insurance

Green insurance – which also goes by several other names, including environmental insurance, eco-friendly insurance, and sustainable insurance – is expected to surge in the coming years as governments and companies strive to achieve net-zero greenhouse gas emissions. As McKinsey noted, “Insurers have opportunities to identify and develop climate-focused solutions in three major areas: insuring the net-zero transition, creating new risk transfer solutions for rising physical risks, and providing adaptation and resilience services.”

This can see insurers offer lower premiums on hybrid or electric car insurance, give discounts for homes built to high efficiency and sustainability standards, or even donate a percentage of each travel insurance premium to mitigate the environmental cost of travel (especially by plane). The potential to enter new business streams is massive and so are many risks, including regulatory compliance, reputational risk (if there are concerns over greenwashing, not meeting the UN Principles for Sustainable Insurance, etc), and limited data availability, which can result in uncertain underwriting and pricing of green insurance products.

Customer-centric insurance

Proving that the customer is king, customer-centric insurance is all about designing insurance products and services around the needs and preferences of customers throughout the entire insurance process. Especially any technology, such as an app, which is used. This includes everything from the ease of purchasing a policy to the quality of customer service to the handling of claims. The goal of customer-centric insurance is to make the insurance process as straightforward as possible and to provide a high level of customer satisfaction, which leads to more loyalty, retention, and revenues.

Achieving this is hard enough (and can be very costly) but making it scalable, consistent, and real at every touchpoint at all times requires ongoing testing that covers a massive number of devices, contact options, environments, and personal preferences. When you may have one chance to keep a customer, you can’t get this wrong.

Digital health services

The use of technology and digital platforms to deliver healthcare-related services, support, and information is constantly growing.

From telemedicine solutions, mobile health apps, wearable devices that track multiple health conditions, remote patient monitoring, health portals, and even the use of AI to analyze large volumes of health data, everything is about improving access to healthcare, enhancing patient care, and empowering individuals to take control of their health.

And as health insurers increasingly play a pivotal role in developing and/or complementing such healthcare services, the opportunities to improve health outcomes, efficiencies, and customer engagement can only get healthier.

No risk, no reward

In the ever-evolving insurance landscape, one thing is clear: insurers must embrace innovation, seize new opportunities, and dare to take risks. Tomorrow belongs to those who break free from the conventional, explore uncharted territories, and boldly redefine what’s possible.

For insurers, the future is where limitless possibilities meet unparalleled protection.