“More than ever before, we can shape the future in truly transformational ways. From small businesses on Main Street to global enterprises trading on Wall Street – the time is now to unite technology and human ingenuity to reinvent how we do business.”

Let’s take a quick look at some of the keynotes and summits that caught our attention – and along the way, check out some of our thoughts about MWC2022!

Scaling up the music space

Our first session of note was under the Tech Horizon theme and looked at the recent technologies set to benefit music, and where music would benefit other technologies.

Session speakers included Ben Costantini, Founder and CEO, Sesamers; Georgia Taglietti, Consultant and Strategist, Founder, International Consulting Network for Arts & Culture; and Agnes Bliah, Global Business Development director, Deezer.

As Georgia noted, “Music and culture is a field of innovation, music is intangible, the music business makes it tangible.” Though, as Agnes also said, “Music is the coolest business to be in but also the most complex.”

Some key takeaways included:

- AI would help build meaningful features within streaming services and apps.

- That music was, as Georgia said, ‘the soundtrack of technology’ and was ideal to be leveraged as an asset and content.

- When building music-based products, music can be key in building loyalty, because, as Agnes noted, “Fan engagement makes music products sticky, we want to hear our favorite artists/playlists.”

- Finally, metaverse integration is a natural evolution of the music industry.

From our point-of-view at Testbirds, there is massive potential in tapping into the music market. No matter what digital solution you’re developing, enabling users to integrate their music could be a great way of ensuring long-term loyalty. Conversely, perhaps your new digital solution just might be the next big revolution in the music industry?

“The music industry is incredibly dynamic – I think in the coming years some amazing collaborative solutions are going to appear. That aside, my favorite highlight of the show was seeing so many people getting together and willing to have a conversation. Also, I was very impressed about how far technology has gone and how far it will go!"

Digital payment landscape

At our next interesting session, five speakers were invited to discuss “the converging world of payments and digital identity, while taking a closer look at evolving business models and how operators and fintech organizations can work together to truly unleash the power of digital payments.”

Session speakers included host Sulabh Agarwal, Managing Director, Global Payments Lead at Accenture; Keith Grose, Head of International, Plaid; Ahmed Alenazi, CEO, STC Pay; Matija Razem, VP Business Development, Infobip; Mariam Cassim, CEO Financial Services, Vodacom Group; and Carol Grunberg, Global Head of Partnerships and Innovation, TTS, Citi Bank.

Keith talked about the way open banking and open APIs are changing how the industry interacts with customers and enable payments. He felt that (from Plaid’s perspective) the use of such APIs to create Open Banking solutions is becoming a global phenomenon – but it is ‘happening in different ways in different regions. Such development is market-driven in the US (by the demand for FinTech) but within the UK and EU, development is being made around an already existing structure (the PSD2 directive), which is leading to a faster move to value-added services.

Payments via a smartphone app are the future; especially as it has never been easier to integrate and innovate. But mobile phones are capable of far more. As Matija discussed that the mobile phone is “…at the same time an app, which you can use for payments, for banking applications, for anything. For communication. But you can also use it for identification.”

Because of all of this, and the prevalence of smartphones, making the apps secure is essential. Everything is connected. From payments to e-commerce and a huge range of services, such super apps are enabling us to buy goods and transfer money as we want, when we want.

Other key takeaways included:

- Digital payments will continue to evolve. Single sign-on, single security, for a seamless customer experience.

- Traditional methods are disappearing and new tech for multi-factor authentication (2FA) and biometrics is becoming a global standard.

- Finance needs to be borderless and have interoperability. Large organizations need to think borderless and build systems and ecosystems around that concept. As Keith mentioned (and which is probably the key takeaway), “the future of finance is fast, borderless, and mobile-first. We’re in the middle of a global shift of how we pay”.

- 5G brings speed and connectivity, money moves at the speed of data, and the speed of access to credit/money/transfers is ever increasing.

- The programmability of money is taking the user experience to the next level.

At Testbirds, we can see that because of digital, the financial industry is quickly changing. Mobile ‘super apps’ can provide financial services that are fast, simple, and secure – to anyone, anywhere. The potential is huge. Especially when it comes to providing a great value proposition and customer experience.

“Payments was one trending topic that really stood out for me. Quick, easy, secure… the development in payments is super interesting and I liked seeing some practical applications of open banking. We also had lots of conversations about scalability, with the age of remote working actually being able to test physically can be a real challenge.”

Fintech Summit: Digital Assets Landscape

Continuing with the world of financial technology, the Fintech Summit on the digital assets landscape introduced us to the fascinating technologies impacting the telco industry.

Session speakers included Sophia Bantanidis, Analyst, Citi Global Insights; Julia Carbajal, Global Head of T&M Strategic Partnerships, Celo; Jens Herrmann, Senior Expert Corporate Strategy, Deutsche Telekom and Brian Gorman, Financial Services Vertical Lead, GSMA.

Opening with the statement that digital currencies are now mainstream and are ‘powering the debate on the token economy’, the speakers discuss the key trends and opportunities within the mobile ecosystem.

Sophia kicked off the presentation by looking at the eight emerging technologies that will transform future economies, stating that “the impact of these technologies will be profound.”

The eight included, artificial intelligence, distributed cloud, distributed ledger technology/blockchain, augmented/virtual reality, Internet of Things, 5G, Robotics, and 3D printing.

It’s certainly a list we’ve seen across industries, so no surprise it’s here!

A few things also discussed at this stage were that digital money is quickly becoming the primary currency used and is becoming ‘digital money 2.0’. Also, when it comes to digital money, there’s more than enough space for many contenders.

Market trends also indicate positive momentum. However, several things are required to continue the momentum – blockchain maturity, regulatory clarity, development of digital asset controls and risk management, and an increase in private assets with a digital asset format (see the following image).

The remainder of Sophia’s fascinating presentation focused on the impact of digital assets on the mobile ecosystem (just quickly, this included the fast evolution of payment solutions; the market increasingly requiring agility and transparency; that liquidity is globally fragmented; the enablement of payment agnostic solutions is critical; and digital assets can drive consistency, speed, and standardization. Additionally, new forms of payment are being developed – while the exchange of value between them is happening simultaneously; mobile operators have a unique vantage point to unlock the value of new digital currencies, and it’s not just about creating new forms of payment but new business models).

For Sophia, digital assets are the optimal payment form for the metaverse.

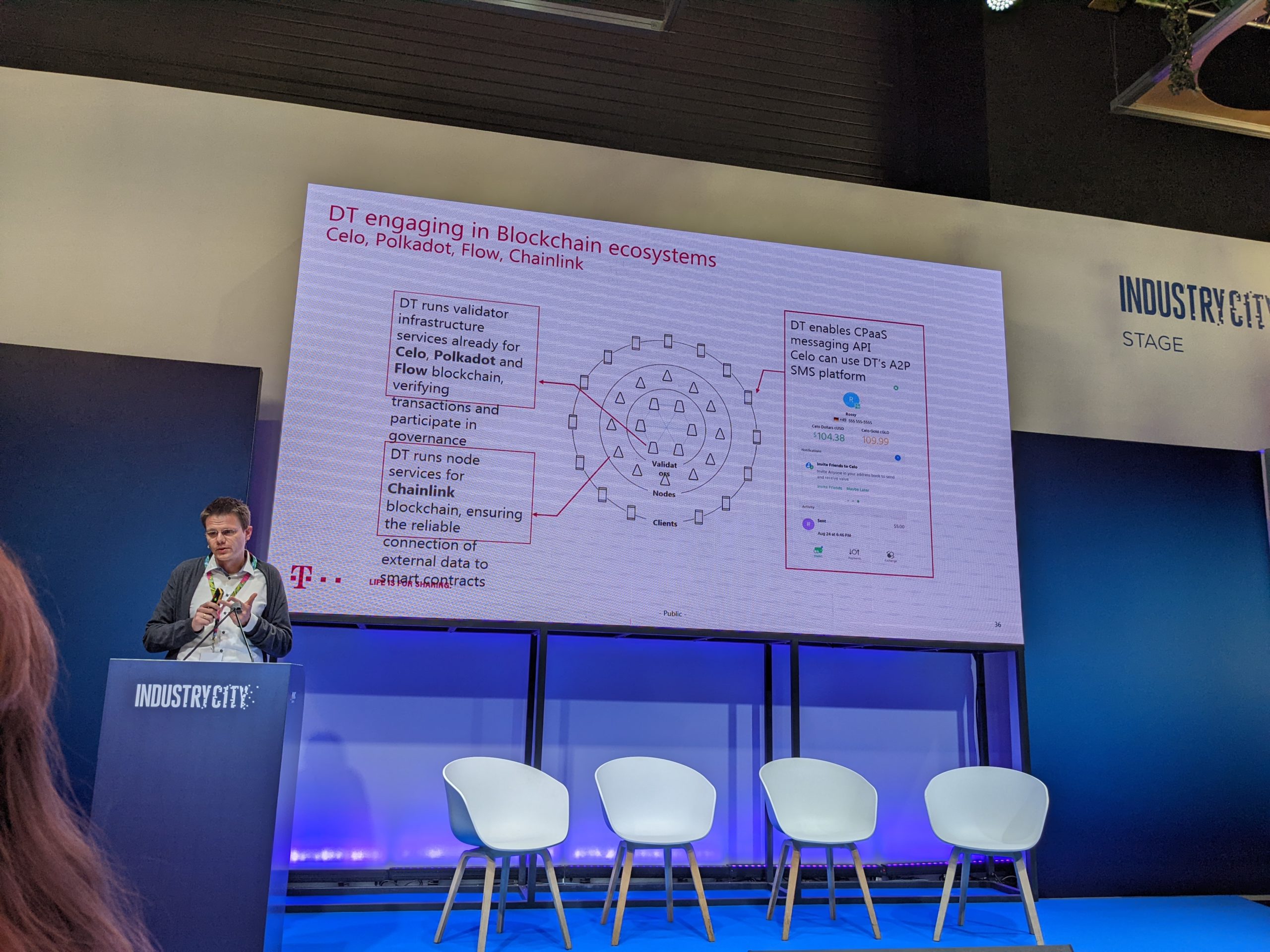

The next speaker was Jens from Deutsche Telekom, who addressed the question of ‘Why digital assets matter for telcos?’

For Jens, the telecommunication industry is in the midst of an infrastructure evolution that will increasingly use ‘Web 3.0’ technologies, such as artificial intelligence, blockchain, and extended reality (artificial, virtual, and mixed reality).

And the main digital asset for telcos to enter Web 3.0, is a combination of digital wallets. This includes a Software Wallet that links your PC or mobile to your bank account, a Web Wallet that is hosted by a third party such as a cryptocurrency exchange, a Cold Wallet that is not connected to the internet but is contained on a digital device like a USB drive, and finally, a Hardware Wallet that is specifically designed for maximum security to store cryptocurrencies.

Jens then discussed how Deutsche Telekom is investing in the blockchain payment platform, Celo (pronounced ‘tselo and meaning ‘purpose’ in Esperanto), to help them “empower anyone with a smartphone anywhere in the world to have access to financial services, send money to any mobile phone number and pay merchants on a decentralized open platform that is operated by a community of users.”

From there the discussion got pretty complicated, as Jens outlined Deutsche Telekom’s move into the blockchain ecosystem. See the image below – one picture truly is worth a thousand words!

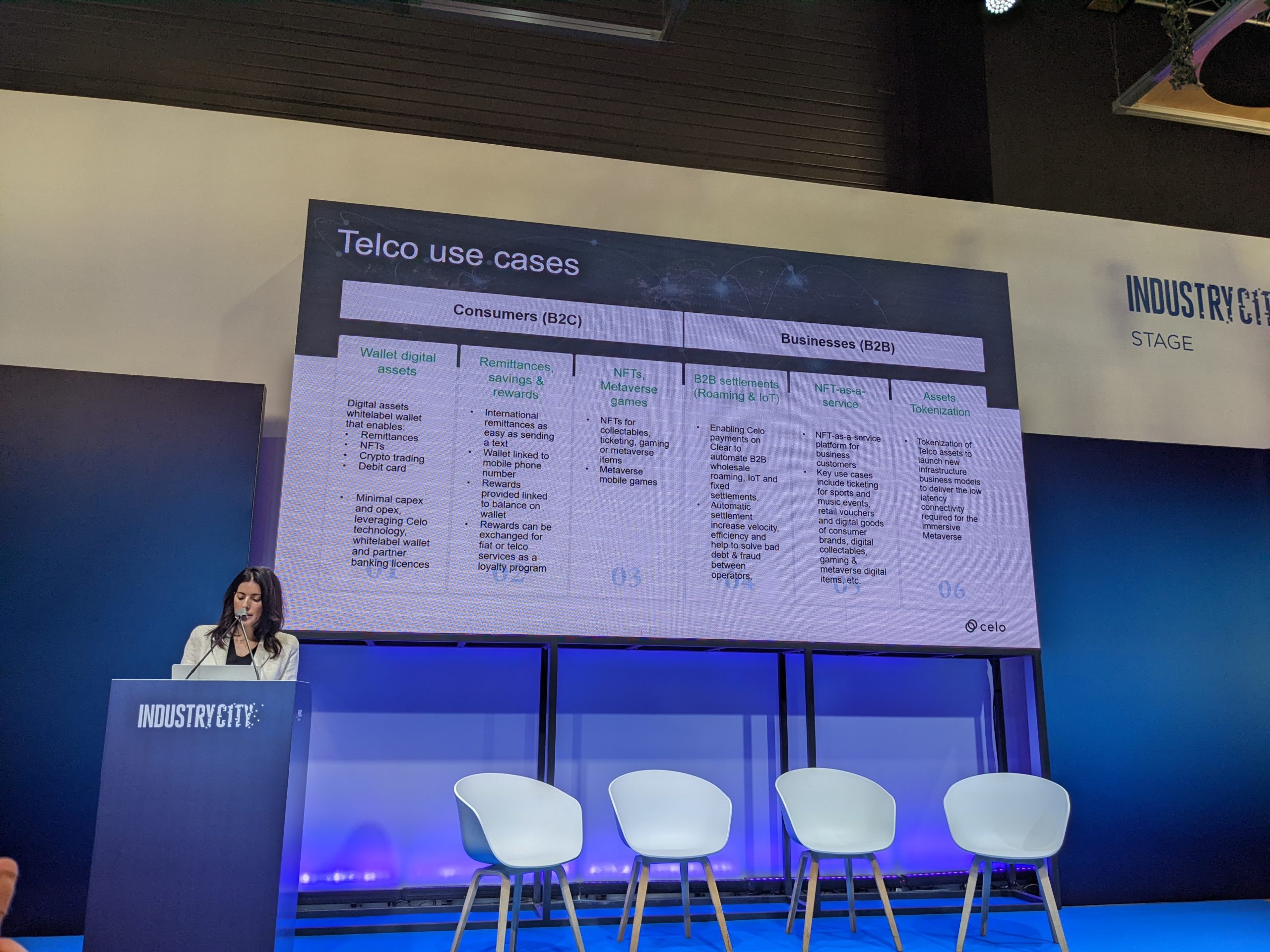

Next up was Julia from Celo who provided a fascinating overview of how their solution is helping to ‘create the conditions for prosperity – for everyone’ by working alongside telcos to provide a full solution that encompasses global licenses, a global custodial wallet, and a global cash-out network.

To summarize: “Celo is a fully EVM compatible proof-of-stake layer-1 protocol, featuring a fast ultralight client and built-in seigniorage stablecoins, collateralized by crypto and natural assets.”

Okay, we didn’t know what seigniorage was either. It’s the “profit made by a government by issuing currency, especially the difference between the face value of coins and their production costs.”

While we’re here… EVM stands for Etherium Virtual Machine… and a stablecoin is ‘any cryptocurrency designed to have a relatively stable price’.

That said, their platform is an ideal fit for both business-to-consumer and business-to-business.

As with Deutsche Telekom, Celo also felt that wallets are the door to Web 3.0 for Telcos and easily support Celo assets. This would ensure that Telcos could launch services and provide secure solutions that enable people to freely exchange and store money on their mobile phones.

“Telco operators,’ said Sophia, ‘can leverage Celo’s tech with no need to invest into their own infrastructure, they can use a white label solution, and generate business cases and revenues by providing access to their customers.”

At Testbirds, we know that as technologies become more complicated, they must balance the essential needs of usability and security. The world of cryptocurrencies and non-fungible tokens is so new, that comprehensive testing of any digital solution dealing with them is essential.

“It is very clear to me that Fintech is taking over. I don’t think I’ve ever heard so much about fintech and seen so many companies and technologies that are somehow related to it. Seeing the applications and new concepts that are being innovated was very interesting. Another real highlight for me was the robots. Seeing ‘Spot’ from Boston Dynamics, having a beer poured by a robot, seeing AI-driven sanitization robots – and more – was great.”

Fintech Summit: Fintech Disruption

Continuing with the world of fintech, the next session we watched was all about disruption.

Session speakers included George Held, Chief of Staff, Veon; Brian Gorman, Financial Services Vertical Lead, GSMA; Sitoyo Lopokoiyit, Managing Director at M-Pesa Africa and Chief Financial Services Officer, Safaricom PLC; and Puneet Chopra, Chief Growth Officer, Yabx Technologies.

The panel took a close look at how fintech and mobile networks are aligning and how fintech is ‘enabling the creation of powerful, disruptive propositions that are redefining the market’.

George started the session by discussing how Veon, Beeline, and Alfa Bank worked to create a culture of collaboration with banks and telcos. The ‘secret’, he felt, was to put both in the same facility and clearly define streams of activity.

Such collaborations can help develop financial solutions that benefit everyone in society by disrupting existing financial services, especially for those with limited access to them. It’s a win-win scenario. As Sitoyo elaborated, “…if society is successful then we will be successful.”

“Increasing financial inclusion” was a clear 5-year-goal of his. Puneet, whose company Yabx creates financial identities based on the user’s digital footprints from telco data, noted that ‘96% of those who borrowed paid back loans on time’. Clearly, people are increasingly comfortable using such solutions.

At Testbirds, we see collaborations all the time. In many ways, they bring new ideas and techniques together to create something special – and hopefully benefit society as a whole. But it can also greatly increase the complexities – both because of different cultures and ways of working – and by combining different technologies. Comprehensive testing can ensure that products work as intended, that bugs are dealt with, and that it meets each user’s needs – regardless of how the product is developed.

“I must admit, the development of digital solutions that give people easy and secure access to financial services – regardless of their socio-economic status – is very welcome and to hear it was a definite highlight. My other top highlight of the show was seeing all the serious developments in tech from real life holograms, robot doggies, and now 6G. StarTrek is the next step! It was also clear that people love testing and research.”

Fintech Summit: Transformation of Payments

Once again, we delved into the world of digital wallets and how technology (such as the Internet of Things) is creating multiple payment opportunities and transforming the payment experience.

In this session, key developments were discussed along with thoughts on ‘what’s next’ for the future of payments.

Session speakers included Richard Cockle, Global Head of Identity, GSMA; Lauren Jones, Senior Advisor in Payments Standardization and Policy, Huawei; Sulabh Agarwal, Managing Director, Global Payments Lead, Accenture; and David Palmer, Blockchain Lead, Vodafone.

When asked ‘How do you see mobile wallets evolving considering the different shifts in the payment landscape?’, Sulabh answered that “What’s happened over last decade is we’ve created fragmented experiences, added different payment methods, adding devices, etc. Next up is personalized experiences. Telcos are at an advantage with their customer data and can leverage that. They need to think about what the journeys are that they want to lead in.”

For David, there is a “huge potential in IoT payments; moving to a world where all people, businesses, devices, will have a wallet and enable the “economy of things”, but we’re just at the beginning.” This was backed up by Astha who commented that the “payments sector is dynamically evolving, both for consumer and business.”

In discussing ‘what next’, Jim felt that payments would be increasingly about “People taking control of their identities and the values we exchange with platforms. For example, all news is being fed to you for the benefit of the news platform, the new newsfeed will be personalized, and the audience has control of what content they receive.”

There’s little doubt that technological advances have seen a huge growth in innovation these past years. Payments are more diverse, faster, easier, more convenient, and can quickly scale between local and global needs. Getting the customer experience right, the security perfect, and being flexible enough to deal with changing regulations, takes a lot of work. Ongoing testing can ensure your products are always ready.

“New payments systems are certainly going to impact many people – in a positive way. I predict that once 5G becomes truly mainstream, these solutions will rapidly increase in a wide variety of ways. Beyond that thought, I loved going back to such a big show! Although, I do feel they should come up with a system to know how people want to be greeted i.e., handshake, fist bump, or elbow bump. One guy got so awkward I nearly had to just pat him on the back!”

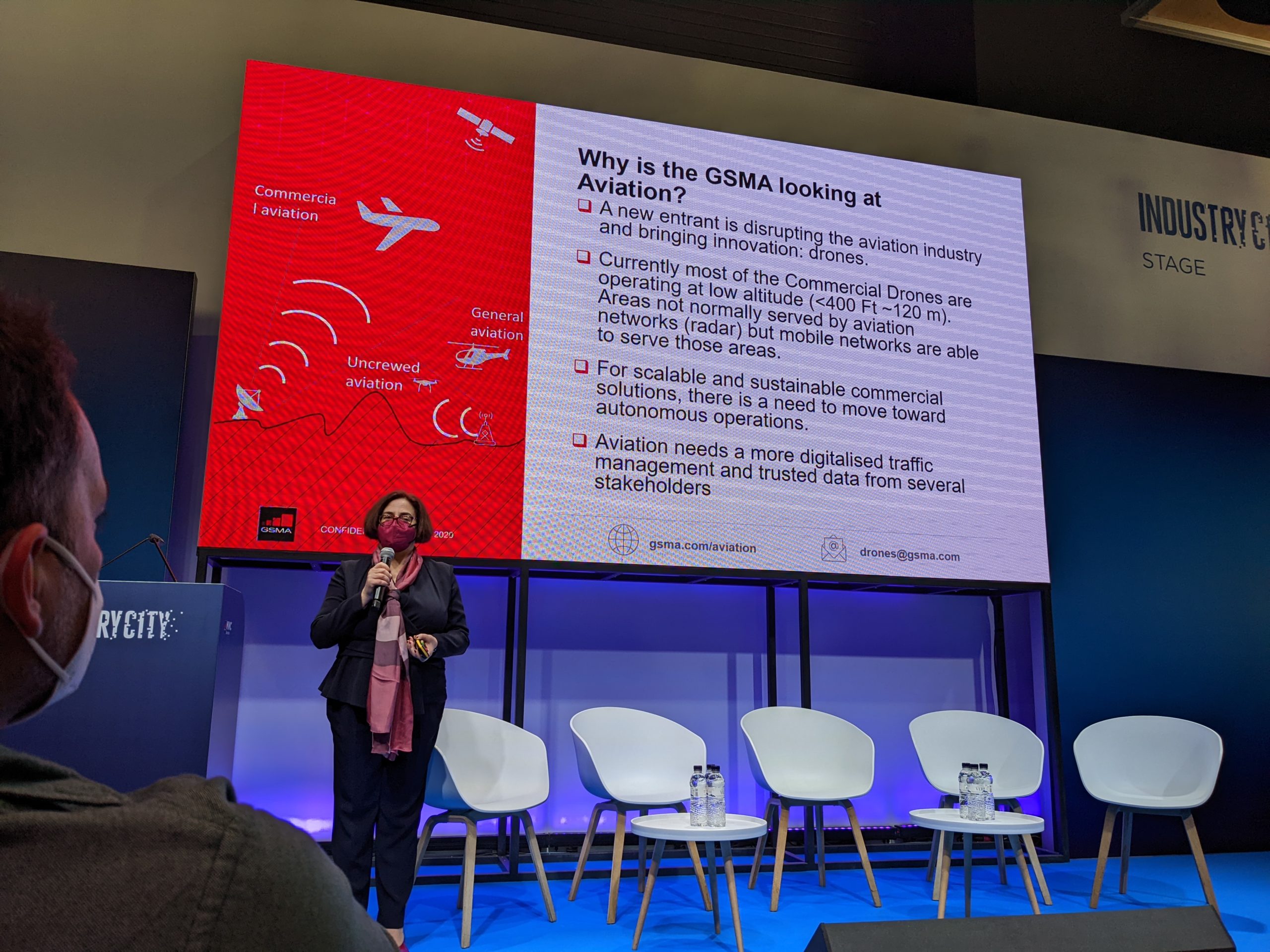

Aviation Summit: Discovering commercial opportunities in advanced air mobility

Taking a step away from the financial world, we also attended this fascinating summit on mobility – specifically regarding autonomous drones – within the aviation industry; where the challenges faced in new business development and advice on cross-industry collaboration were discussed.

Session speakers included Barbara Pareglio, Technical Director, GSMA; Elena Neira, Head of 5G Standards, MITRE Labs; Thomas Neubauer, VP of Business Development and Innovations, TEOCO; Jorge Muñoz, Vice President for Business and Marketing , Unmanned Life; Nora Metzner, Senior Product Manager, Droniq; Miguel Álvaro Fernández, Drones Sales Specialist, Telefonica; Svetlana Grant, Head of IoT Strategic Technology Partnerships, Vodafone; Lorena Senador-Gómez Lázaro, Global Sales Director, Telefónica Ingeniería de Seguridad; and Marc Beltran, CEO & Co-Founder, EU Drone Port™.

It was 45 minutes of a wide-ranging discussion, so we’ll focus on several interesting quotes. After being asked ‘What are the capabilities that we need to put in place to make the vision happen?’, Thomas answered, “it’s not about selling SIM cards or just connectivity, it’s about end-to-end solutions. A municipality is not interested in flying drones, they’re looking for direct surveillance and support in traffic or other city use cases.” Additionally, he said that it would be a very good idea to partner ‘with other players in the ecosystem.’

When asked, ‘Where are we heading in the aviation industry in next years?’, Nora said that “Drones will replace helicopters and allow usage that we cannot handle today with current forms of aviation. We’re bringing together aviation and telecommunications and for aviation, safety is the priority, so connectivity needs to be crucially active in order to keep drones in the air and have backup systems as a safety net.” Francesca also added that “Drones deliver information and goods, and they need to do it safely.”

Finally, Marc commented that “Mobile technology allows Beyond Visual Line of Sight and allows remote deployment and management. Future aims are to bring drone aviation to the same level of safety as commercial aviation.”

Safety is essential. And it’s impossible to guarantee without proper testing at every stage of development.

“The advances made in robotics and drone technology are something to see. Surveillance drone with personal recognition. Bots that can smell coffee and recognize people. Crazy stuff! One of the other topics I loved was when they launched a new car... really shows how much technology gets intertwined with everyday life.”

Workplace 2026: The future of work collaboration and connectivity

Looking at ‘how cutting-edge applications of communication technology will shape our collective collaboration in 2026’ the session focused on talking about how the future of work is ‘personalization, accessibility, and most importantly—happening NOW’.

Session speakers included Wyatt Oren, Strategic Sales Manager, Agora; and Blaise Thomas, Startup Advocate, Agora.

They believed that ‘systems need to be designed around collaboration’. That the ‘more we engage the more we’re able to understand’. And that now is a perfect time ‘to create the solutions for the future’.

Moving forward, there would be four key focus areas that must be considered to meet new workforce expectations: Hybrid formats, intensive experiments, accessibility, and engagement & automation.

A prime takeaway was that our work future will increasingly utilize innovative technology to make our work lives easier, more convenient, connected, and efficient.

It’s clear that testing with people who resemble specific workforces, will be required, to ensure workflows are seamless and that propriety software works with third-party applications.

This led us to our final session at MWC2022!

Everyone loved Barcelona.

Carl: “I love Barcelona although Covid does seem to have made it a little more quiet than usual, it doesn’t take away from how great the city is.”

Fredrik: “It was only the second time I’ve been, and it was great. The city has a great vibe that spills over into MWC. People are happy to be in a city with vitality and sun, and it shows in the way people act at MWC. As a team we had a great time with great tapas, we even went back twice to one place that I had been to last time I visited – L’Ostia.”

Stefano: “I was very tired after the event, but it is a special place! The food was amazing, and the beer was cheap!”

Andrew: “Loved Barcelona but it was a real pity that the Makamaka Beach Burger Cafe was closed.”

MWC2022: What did we learn, who won, who lost?

After four days of many fascinating discussions and demonstrations, the big questions had to be asked!

Session speakers included Peter Jarich, Head of GSMA Intelligence, GSMA; Mike Thelander, President and Founder, Signals Research Group; Carolina Milanesi, President & Principal Analyst, Creative Strategies; Monica Paolini, Founder & Principal, Senza Fili, and Matt Hatton, Founding Partner, Transforma Insights.

Mike felt that overall, it was good to see the progress of 5G and how the industry is working to make it better. However, when it came to identifying opportunities for customers, he felt that ‘a lot of things are getting pigeonholed into the big buzzwords, it should be more honest, more transparent marketing.’ As for what he wants to see at MWC2023, Mike said “I want to see 5G everywhere, give me applications and use cases that show what 5G can do.”

For Carolina, the biggest news was that ‘sustainability was tied into pretty much everything.’ Phones were clear stars of the show but there could have been more about ‘metaverse’, connected cars, and discussion regarding accessibility and digital inclusion. As for next year, Carolina wants to “see progress, see an impact that tech and connectivity are having on society and economics. I don’t want to see goggles everywhere, but I think we will see more next year.”

Monica, on the other hand, felt that there was no single thing that was the ‘biggest news’ but that was a good thing as everything was more “much more balanced, it’s more at a human level, it’s refreshing. As for next year, Monica said that she did “not want to see 6G, no big handsets. Would like to see more about the role of wireless in society, social inclusion, talk more about data ethics.”

Finally, Matt felt that the biggest news was the Deutsche Telekom and T-Mobile’s announcement of their T-IoT solution, a comprehensive enterprise solution for global IoT connectivity, platform management, and support.

Overall, the panel felt that there’s a clear vision with current technology, but they want to see how it’s implemented.

It’s a safe bet we’ll find out in Barcelona next year at MWC2023!

From our perspective, one of the strongest themes we encountered was collaboration. It’s easy to see why. As technologies rapidly change and improve, and consumers demand more, different, and often specialized skill sets are often necessary to develop complex solutions. It’s the same with testing. In-house and automated testing can suffer from operational blindness and miss a million details that impartial human testers can find.

In the end, it’s all about the power of people.